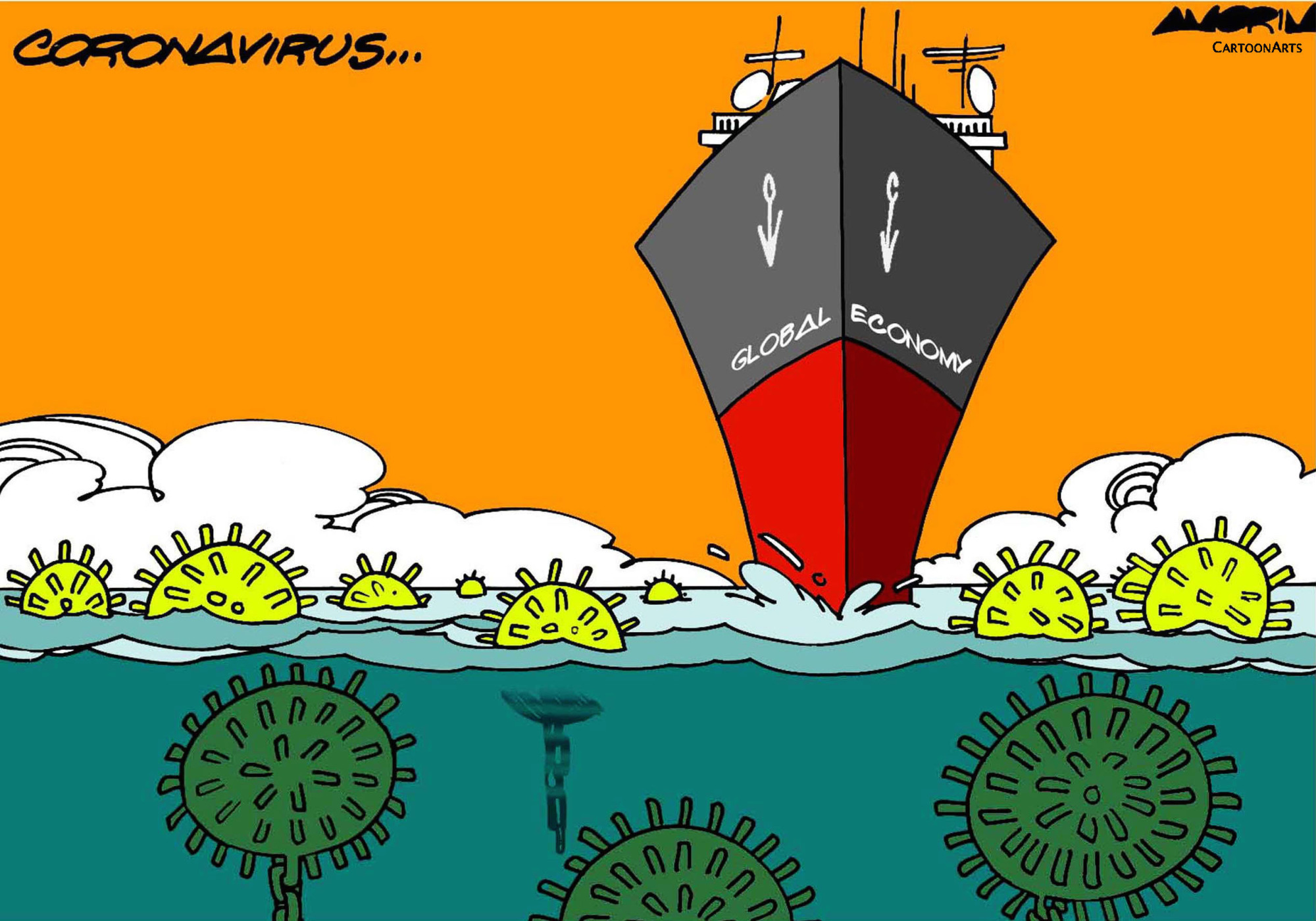

When the coronavirus outbreak first erupted late last year in Wuhan, China, almost nobody imagined that it would become a serious epidemic, spreading rapidly across the globe. While the reported number of newly infected people appears to be leveling off in China, COVID-19 is becoming a global threat as it spreads at an alarming rate not only in Asia, but also in geographically distant Europe, Latin America, Middle East and Africa. At 3.4 percent, COVID-19's fatality rate is low and well below the 2003 SARS figure of 11 percent, but the contagion is far more powerful and has spread to more countries.

The coronavirus outbreak will have a more adverse impact on China's economy than the SARS epidemic did. The latter occurred in the high growth era, which was mainly driven by burgeoning international trade activities and related supply-chain linkages in Asia due to China joining the World Trade Organization in 2001. Greater inflows of foreign direct investment and active manufacturing production and investment projects helped offset the adverse impact of SARS. As a result, China's real GDP growth avoided a slowdown, rising from 9 percent in 2002 to 10 percent in 2003 and 2004.

In contrast, China's economy is now on a downward trend due to the country's aging population and lower productivity growth. This economic slowdown has been exacerbated by U.S.-led trade protectionism, which has weakened China's trade activities.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.