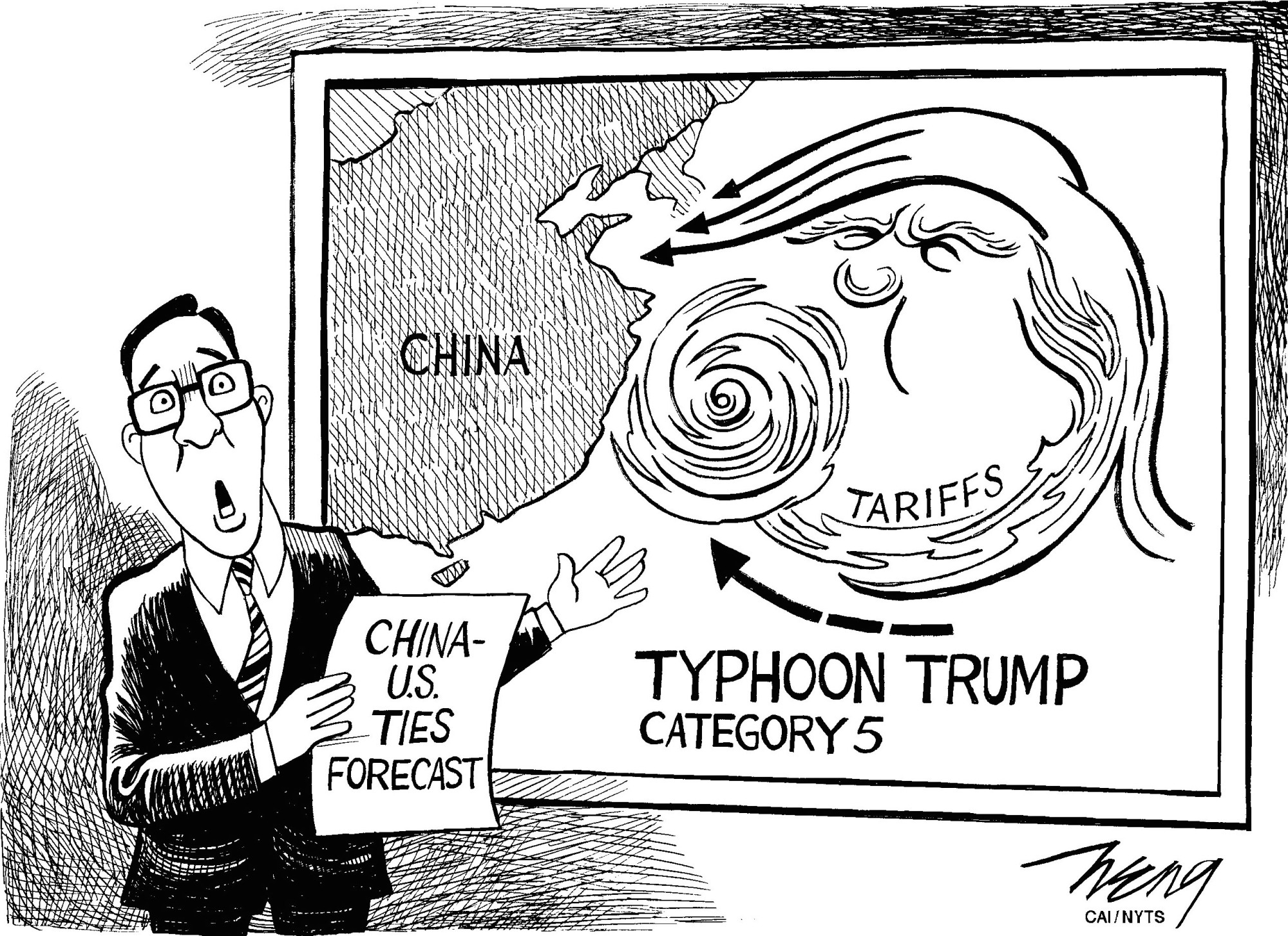

Some observers interpret the trade war that U.S. President Donald Trump has initiated with China as a tough negotiating tactic, aimed at forcing the Chinese to comply with World Trade Organization rules and Western norms of doing business. Once China meets at least some of Trump's demands, this view holds, mutually beneficial economic engagement will be restored. But there are many reasons to doubt such a benign scenario. The long China-U.S. trade war is really a manifestation of a fundamental clash of systems.

Already, the adverse impact of the two sides' tit-for-tat tariffs — and, especially, the uncertainty that they engender — is plainly visible. For China, the psychological effects are larger than the direct trade impact. China's stocks have dropped by some 30 percent since the conflict began, and further declines are expected. Because equity-backed debt has been issued to China's highly leveraged corporate sector, the decline in stock prices has triggered collateral calls and forced asset sales, putting further downward pressure on equity values.

To limit a negative overshoot, Chinese policymakers have been talking up the strength of equity markets, while shoring up and expanding credit channels for the private sector, particularly for otherwise healthy and creditworthy small and medium-size enterprises, which remain disadvantaged relative to their state-owned counterparts. Whether the government will intervene directly in equity markets remains to be seen.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.