Think of him as the caveman with a heart of gold. No, not Fred Flintstone, the protagonist of one of history's most-beloved animated sitcoms. We're talking about Haruhiko Kuroda.

The Bank of Japan governor just returned from Jackson Hole, Wyo., where he roamed the Grand Tetons with his central bank peers. There, they strategized about how to influence a dynamic world with the most primitive of tools. They staggered back to their respective Bedrocks without a clue how to reignite the monetary fires that once raged so robustly.

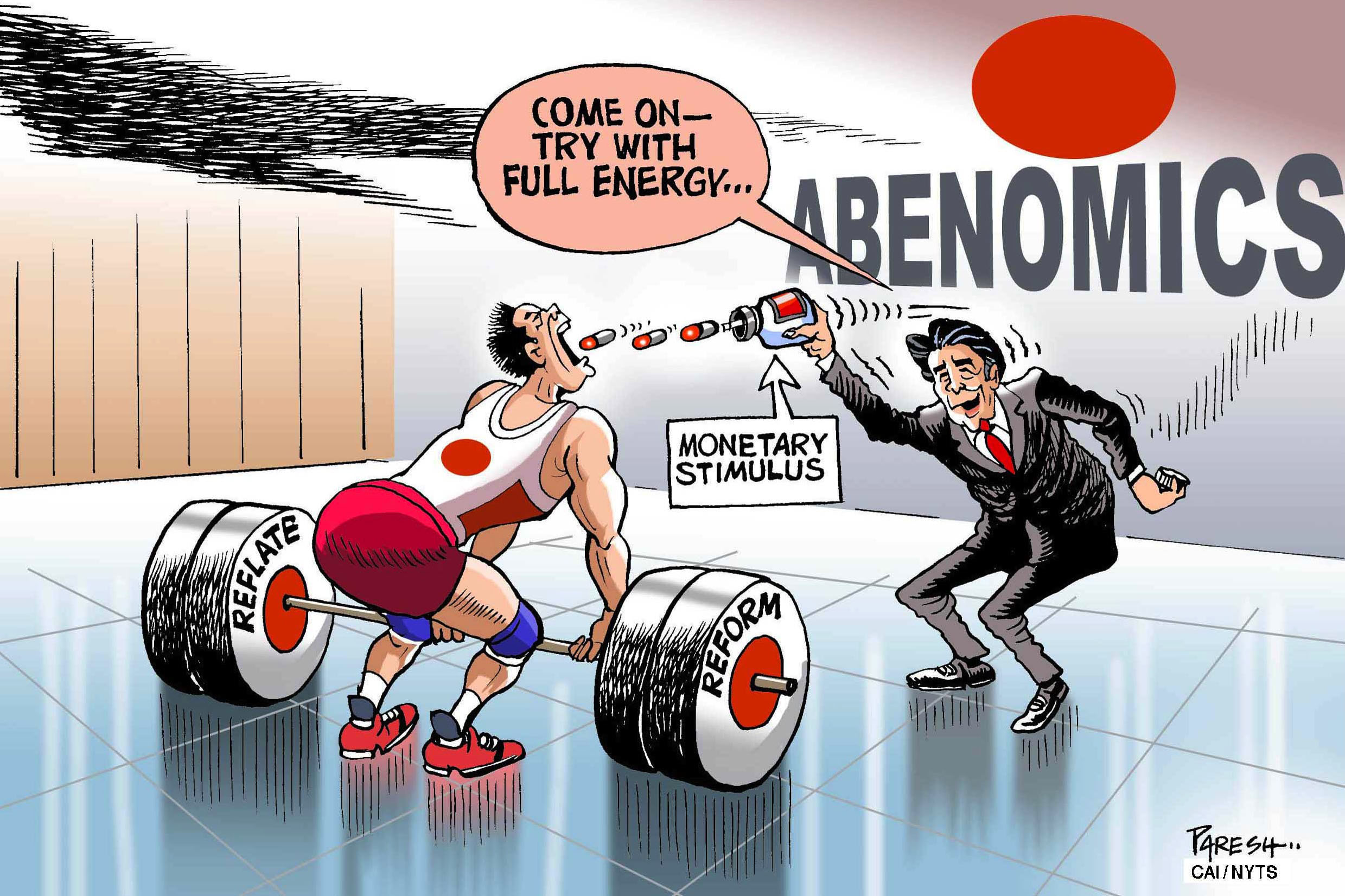

Yet as well intentioned as he is, Kuroda is indeed finding a Flintstonian dilemma awaiting him in Tokyo. It's become increasingly clear that one of his main tools for reviving Japan — the Nikkei 225 — has itself roamed into dinosaur territory. Since 2013, the BOJ has targeted the Nikkei with massive purchases of exchange-traded funds. Why hasn't it revived corporate activity and, in turn, Japanese growth? "The Nikkei 225 is a Flintstones index from an abacus age," argues CLSA equity strategist Nicholas Smith.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.