On March 16, a government panel called the Analysis Meeting on International Finance and Economy held its inaugural session. A briefing paper on the panel, released by the Cabinet Secretariat on March 1, stated: "In order to properly cope with the prevailing global economic conditions, Japan, as the chair of the Group of Seven summit to be held in May, will hold a series of meetings to hear opinions from and exchange views with knowledgeable persons from Japan and abroad on the economic and monetary situations of the world."

The members of the panel are seven Cabinet members and the governor of the Bank of Japan. They meet behind closed doors. A summary of minutes was released only for the initial session.

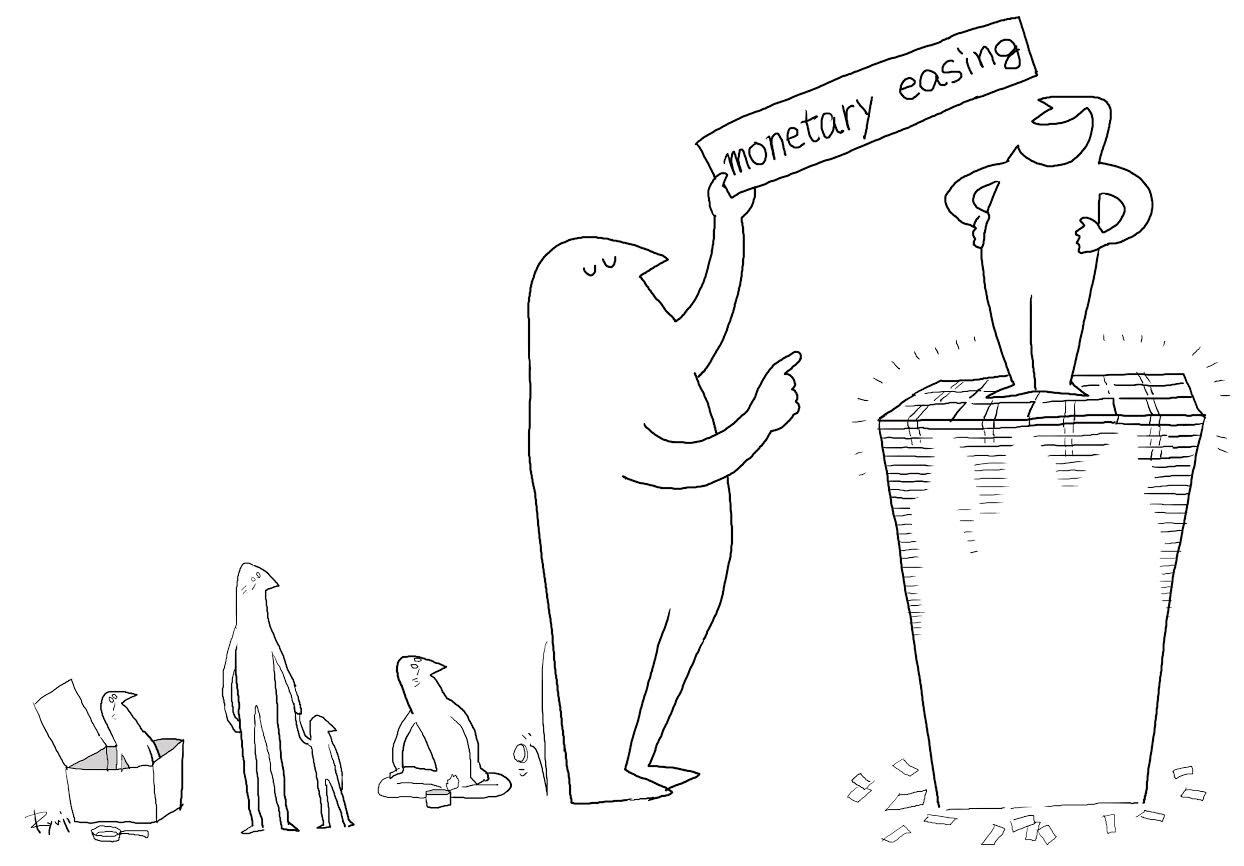

Preparing for the G-7 summit by inviting such authorities on the international monetary situation as Nobel laureates in economics as guests is only ostensibly an official purpose.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.