As the clock winds down on Haruhiko Kuroda's tenure as head of the Bank of Japan, Deputy Gov. Masayoshi Amamiya has been approached by the government for the role, the Nikkei daily has reported.

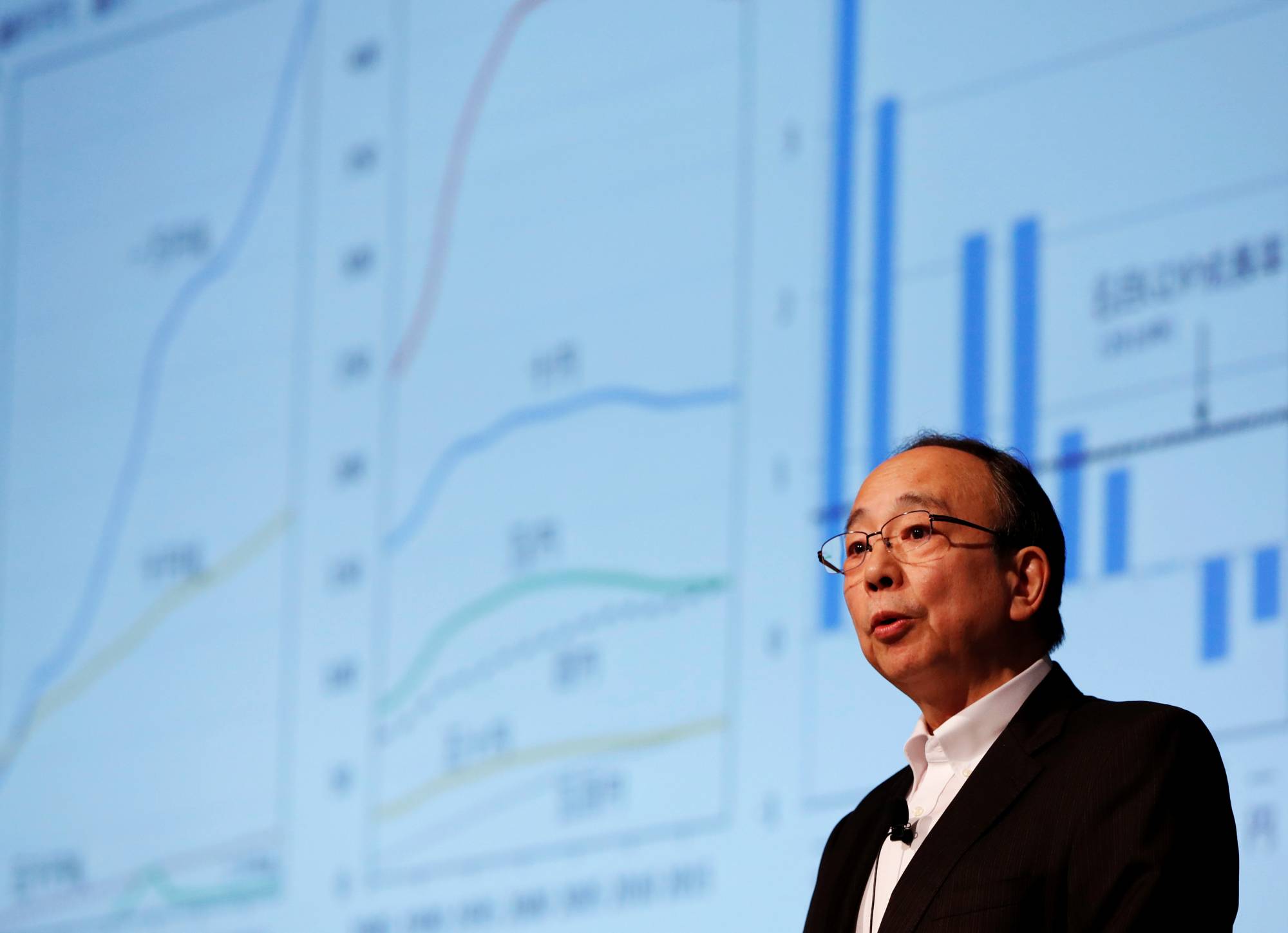

Amamiya, 67, who joined the BOJ in 1979, has long been viewed as a front-runner due to his extensive experience crafting the bank’s strategies and policies. Nicknamed "Mr. BOJ" and “The Prince” in the media, Amamiya possesses deep political connections useful for setting policy and in-depth knowledge of the bank’s internal workings.

The yen dropped 1% following the Nikkei report.

In response to reporters' questions, Deputy Chief Cabinet Secretary Yoshihiko Isozaki said there was no truth to the Nikkei report, while Finance Minister Shunichi Suzuki said he had not heard that the government had offered Amamiya the job.

Amamiya has not yet publicly commented.

Other names reportedly floated for the job have included Hirohide Yamaguchi and Hiroshi Nakaso, both former deputy governors. The latter may no longer be in the running, having recently taken a post heading an Asia-Pacific Economic Cooperation advisory council.

BOJ governors are appointed to five-year terms. Kuroda's ends on April 8.

The government is expected to present leadership nominees to parliament next week, Kyodo has reported.

Who will lead the BOJ has been a topic of immense scrutiny over the past few months, with any potential developments on the successor watched closely.

Under Kuroda, the BOJ has maintained a so-called yield curve control policy — a strategy of purchasing unlimited amounts of 10-year Japanese government bonds to control yields — but with rising inflation and a weak yen, this approach has been criticized.

In December, a minor policy modification was announced, but Kuroda said that it was “still premature to talk specifics about (changes) to the framework of monetary policy and an exit strategy.”

It will be a tough road ahead for whoever steps in.

Krisjanis Krustins, director of sovereign ratings for the Asia-Pacific region at Fitch Ratings, said the next governor “will likely have to balance the goal of achieving the BOJ's inflation target against the negative spillovers of ultraeasy monetary policy, and potential risks around any policy tightening.”

That will be no easy feat. Goushi Kataoka, PwC chief economist in Japan and a former BOJ board member, told the Financial Times last month, “For any candidate, you don’t want to be a governor now because there is no margin for error.”

Krustins notes that while the BOJ is facing market pressure to tighten policy, this must be carefully enacted.

“There is a risk of tightening too early, just as there is a cost to continuing loose monetary policy,” he said.

Analysts say Amamiya is more dovish than other potential successors, and will likely make gradual changes — while he has spoken in favor of maintaining ultralow interest rates, he has also said the BOJ must consider how to end such a policy.

Saisuke Sakai, a senior economist at Mizuho Research and Technologies, told The Japan Times last month that a measured approach was to be expected in the future.

“The BOJ doesn’t want to be responsible for causing an economic downturn, and the new governor wants to avoid such a failure, so it’s likely that they will take a more cautious stance,” Sakai said.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.