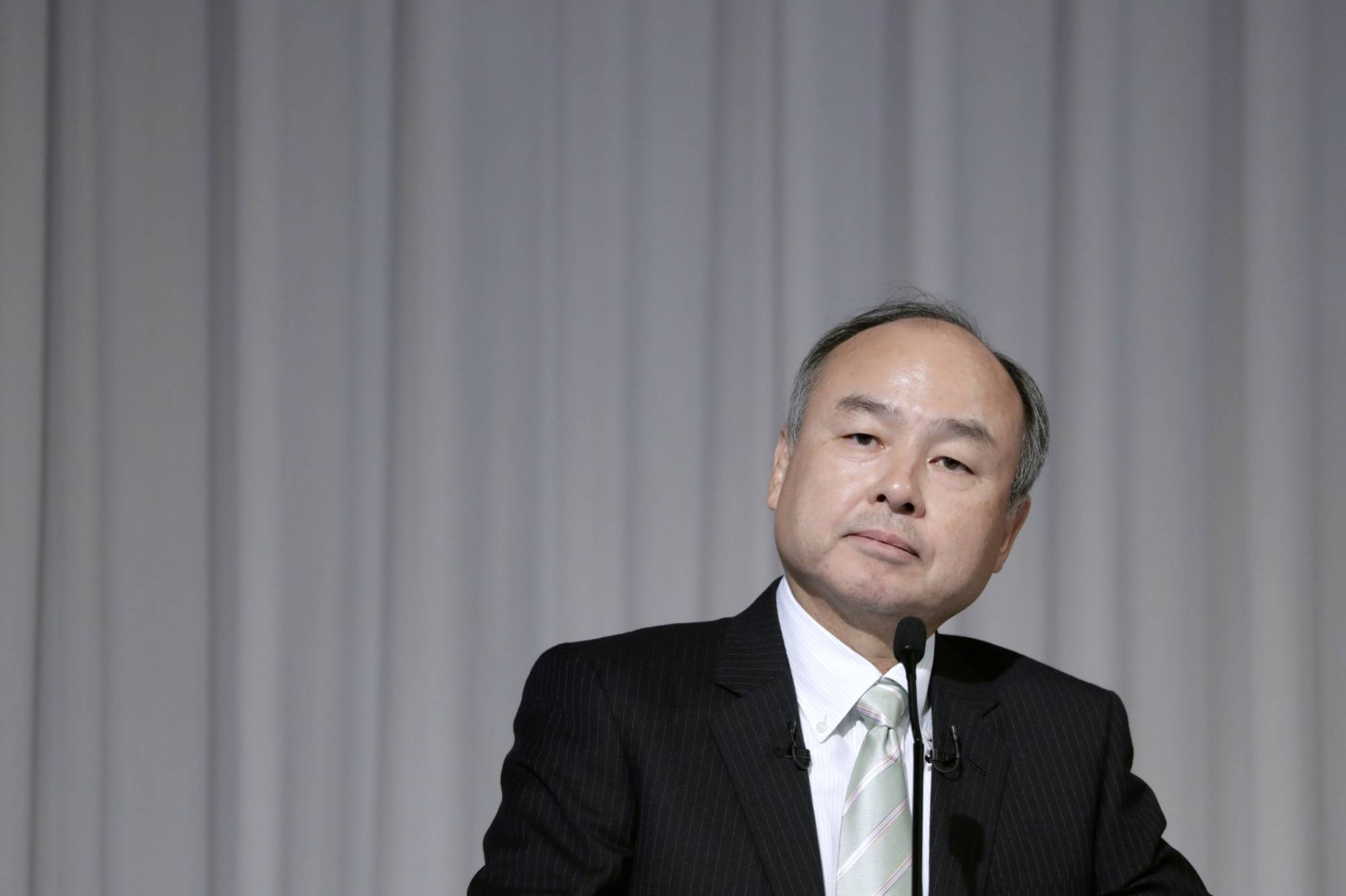

Masayoshi Son has reduced the number of SoftBank Group Corp. shares he’s pledged as collateral to lenders by about $810 million, cutting back after heavy borrowing had raised questions about the stability of his technology empire.

Son trimmed his committed shares by about 14 million to 213 million, according to regulatory filings. The billionaire holds about 562 million shares directly and indirectly, which are worth $33 billion before taking into account collateral.

Son has revived SoftBank’s fortunes after the stock plunged in March because of business missteps and concerns about the coronavirus pandemic’s impact on his portfolio of startups. SoftBank has since embarked on record asset sales and stock buybacks, helping more than double the share price from a low six months ago.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.