Nissan wants Britain to pledge compensation for any tax barriers resulting from its decision to leave the European Union or the automaker could scrap a potential new investment in the country's biggest car plant, its CEO said Thursday.

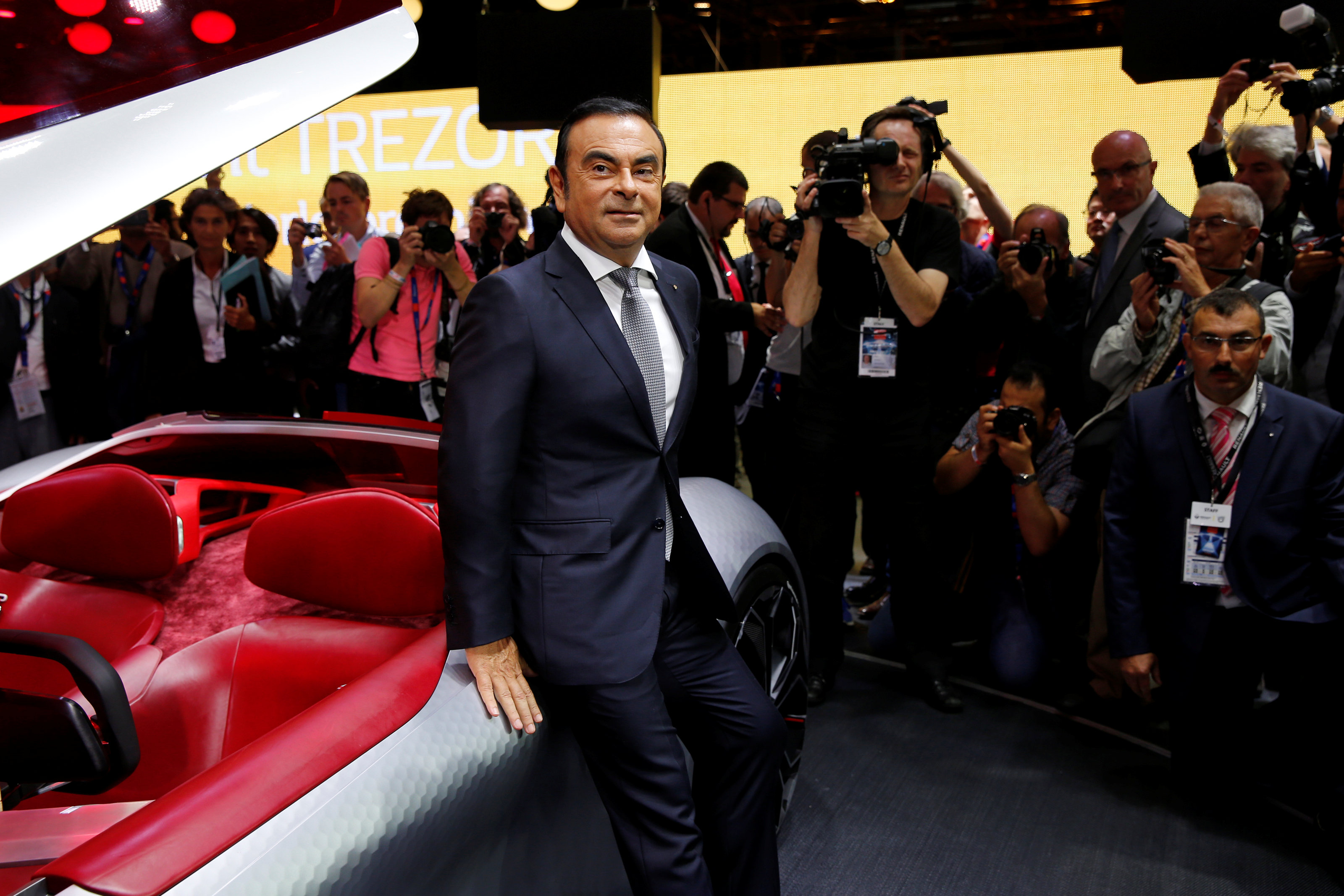

Carlos Ghosn's remarks indicate growing concern among global carmakers that Britain could be heading toward a hard exit from the EU, which would leave them paying tariffs to export U.K.-assembled cars to EU markets.

Nissan, which builds around a third of Britain's total car output at its plant in Sunderland, northeast England, is due to decide early next year on where to build its next Qashqai sport utility vehicle.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.