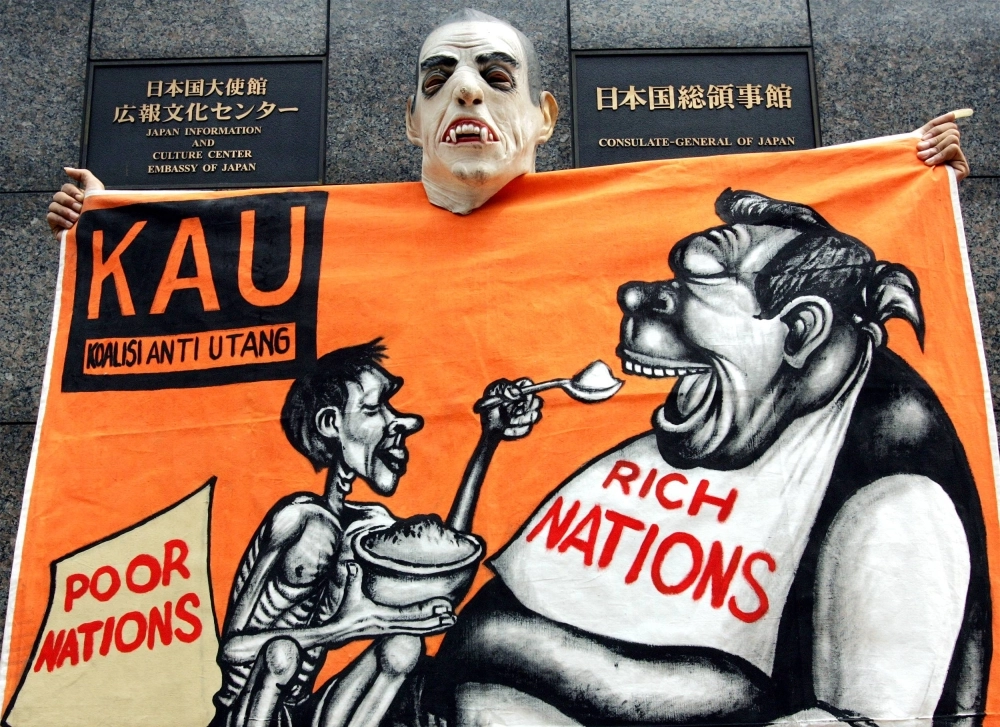

The debt crisis in low-income countries continues to fester. Meanwhile, the international policy community seems to be losing traction on the problem. Can it recover its grip or has a developing-country debt disaster become inevitable?

The number of economies in debt distress had already risen sharply between the global financial crisis in 2008-09 and the eve of the COVID-19 pandemic, as judged by countries receiving an unfavorable grade of B3 or lower from the credit-rating agency Moody’s. Then, when the pandemic erupted, the number of distressed countries stopped rising, as global leaders resolved to address what was now a humanitarian emergency as well as a financial crisis. The Group of 20 countries tabled a Debt Service Suspension Initiative, which temporarily relieved troubled countries’ governments of the need to repay.

But once the DSSI expired at the end of 2021, the number of distressed sovereigns began rising again, in part because higher global interest rates made it still harder to service debts. The number of countries in debt distress, as measured by Moody’s, currently exceeds 40.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.