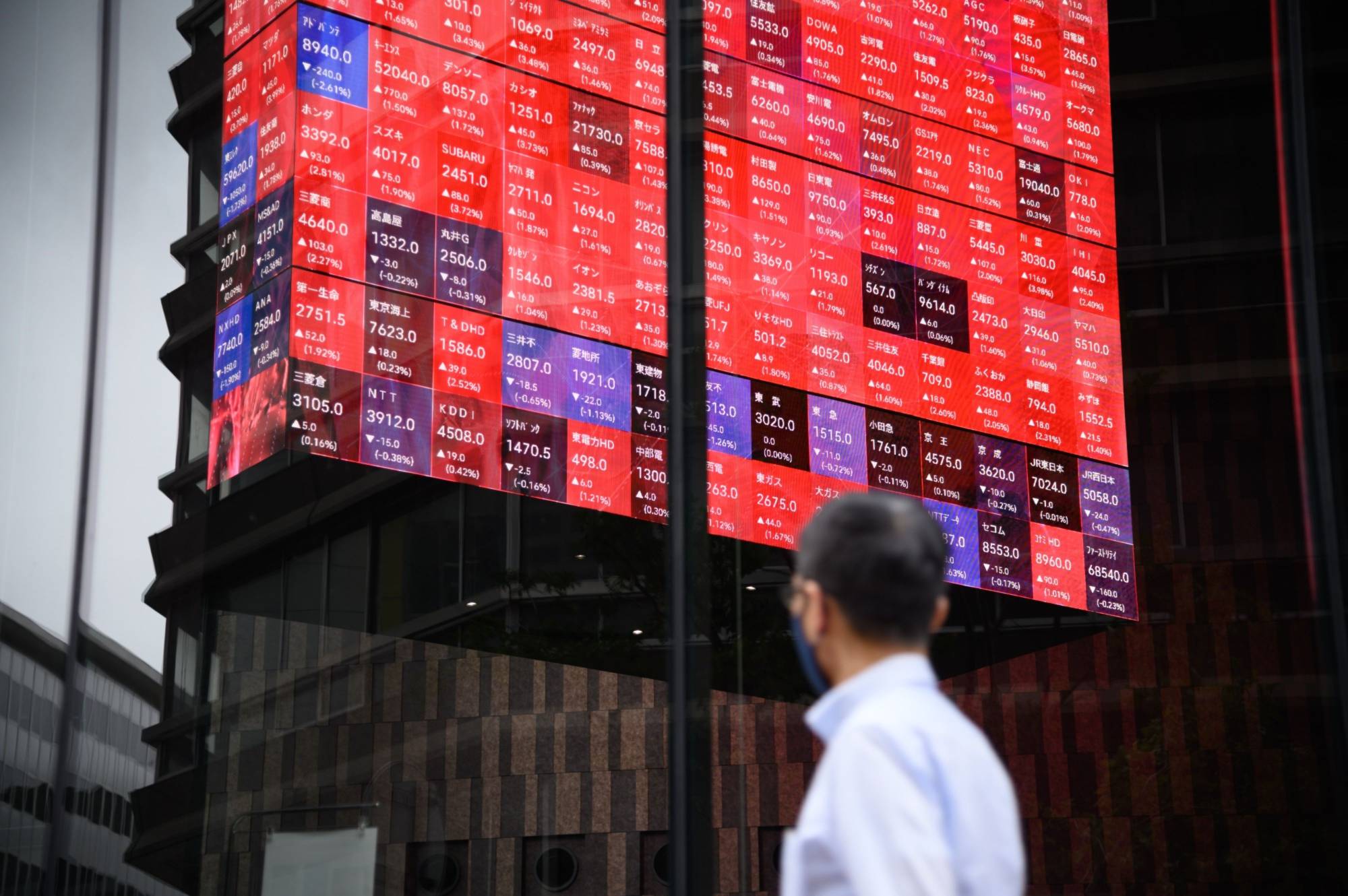

The Tokyo Stock Exchange's foray into listing actively managed exchange-traded funds next year may do little to boost liquidity for a market faced with foreign outflows, investors say.

The TSE is planning to launch these ETFs in June as a way to stem thinning volumes and remain competitive against global peers, the bourse’s senior manager of equities Kei Okazaki said in an interview last week. The introduction comes after years of internal discussion on how to attract more foreign investors, he added.

The development is the latest effort by the exchange operator to enhance the market’s global status by introducing investor-friendly reforms. The measures so far, including a restructuring of market segments in April which was touted as the biggest revamp in 60 years by the bourse, have been met with a muted response and are seen as largely symbolic.