U.S. President Donald Trump's bashing of Japanese automakers escalated from his criticism of Toyota Motor Corp.'s plan to build a new plant in Mexico to a call on the automakers to boost their output in the United States and to a demand that Japan import more made-in-America vehicles.

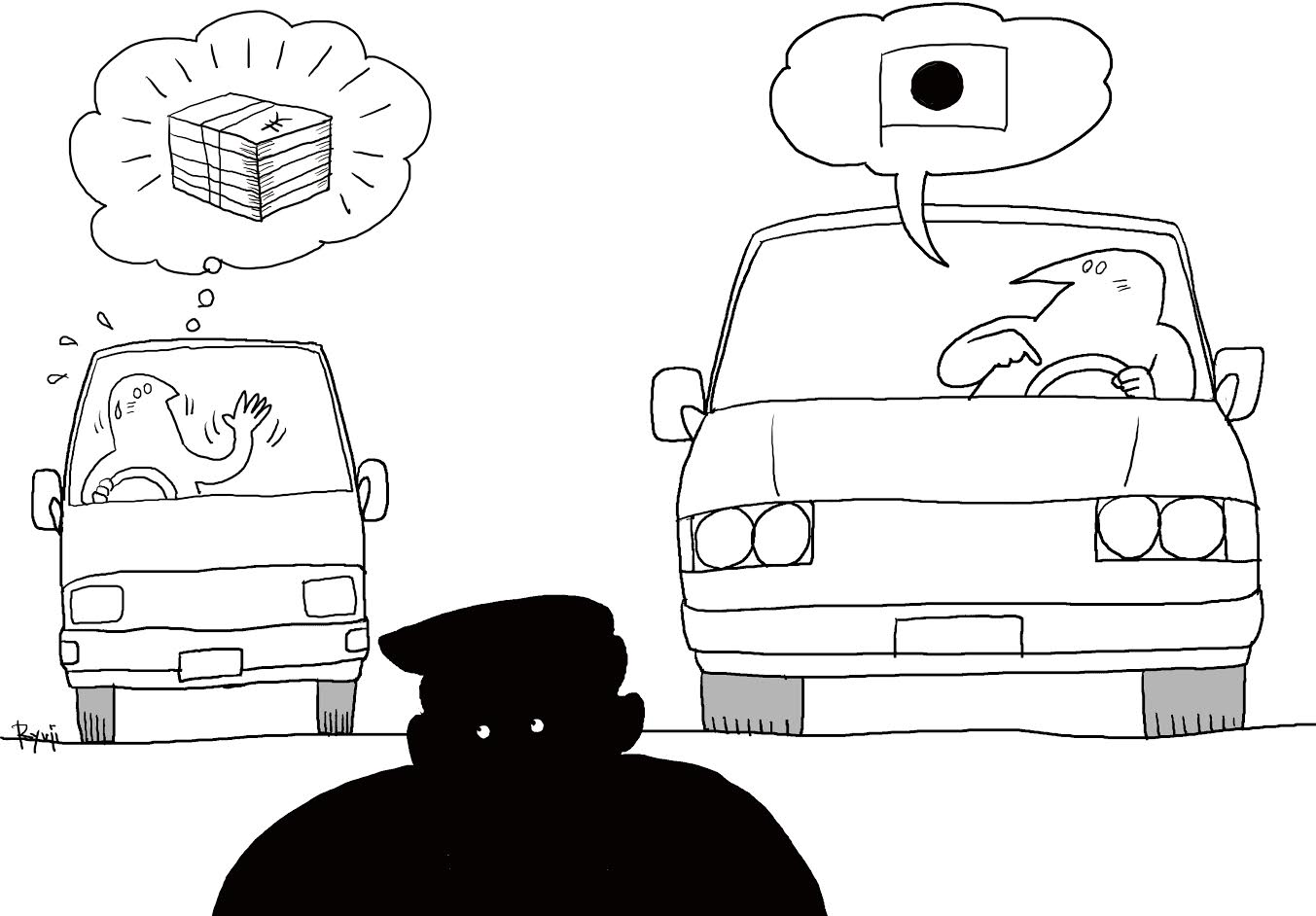

The tone of his rhetoric sounds far more radical than in the demands made by the administration of U.S. President Ronald Reagan in the 1980s, when the bilateral friction over trade disputes were at its peak. Trump will likely not let up until there are visible signs of progress such as recovery in employment by the U.S. automakers and their exports. The only choice left for Japanese makers like Toyota and Honda may be importing the vehicles made in their U.S. plants to Japan.

Alarmed over Trump' increasingly protectionist rhetoric, one Toyota insider started reviewing the history of Japan-U.S. auto trade talks of the 1980s — in hopes of finding clues to coping with the emerging situation.