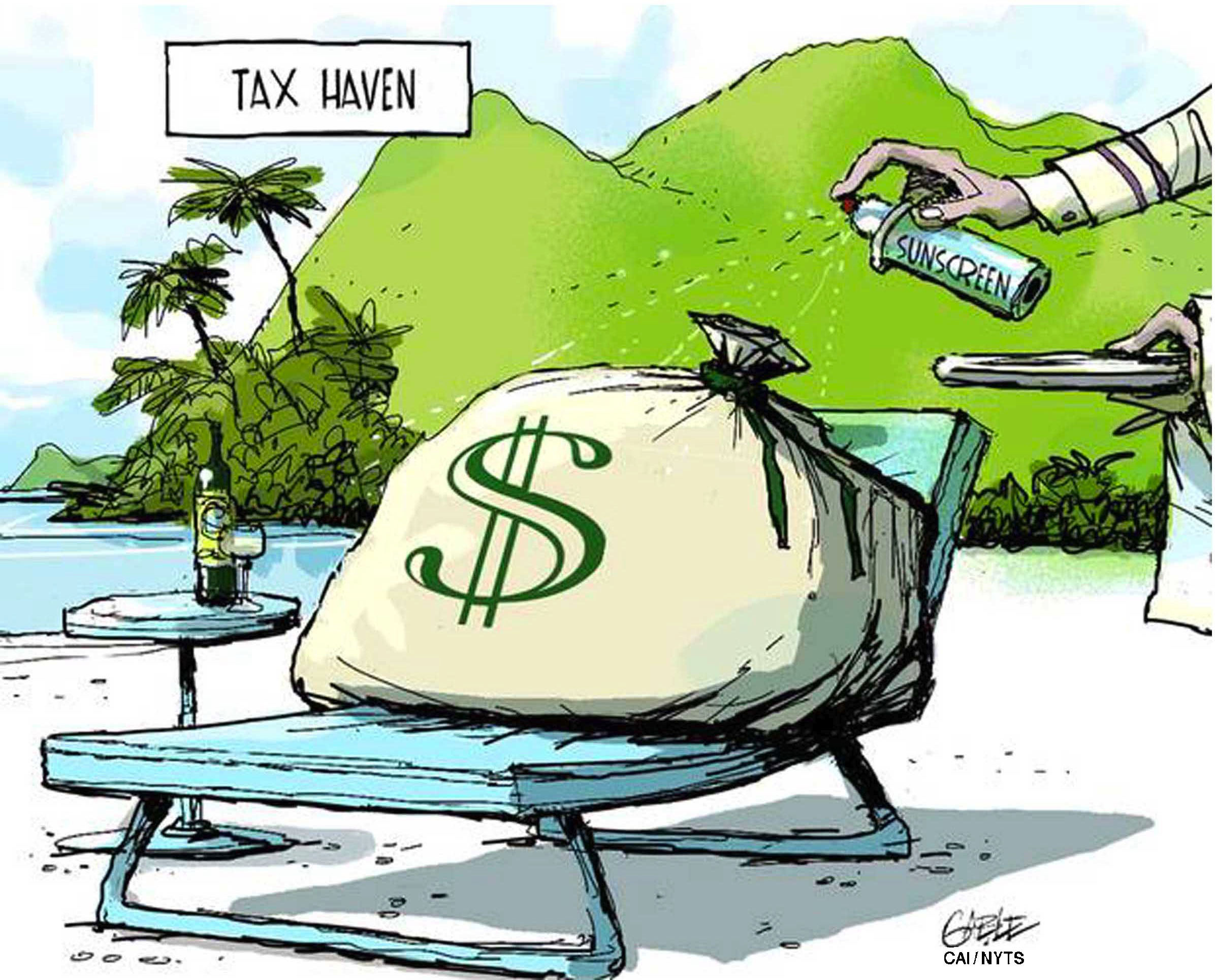

Even though issues related to tax havens have made big headlines following the disclosure of the Panama Papers, little attention, if any, has been paid to the fact that the United States is now the world's biggest tax haven.

Indeed, Washington has pursued a strategy of destroying tax havens in such countries as Switzerland, establishing a system to absorb global money into the U.S. and helping U.S.-headquartered multinationals avoid taxes.

A global war over taxation is likely to be intensified as the European Union has launched tax reform aimed at preventing the U.S. government and corporations from taking the lead in this area.