In early March, before the coronavirus pandemic triggered a global economic lockdown, SoftBank Group Corp. founder Masayoshi Son paid tribute to Rajeev Misra, the man who runs his $100 billion technology investment fund. Wearing a $70 (¥7,500) Uniqlo down jacket, the Japanese billionaire put his arm around Misra’s shoulders at a town hall meeting in San Carlos, California. He said he would never forget the help Misra provided when he was at Deutsche Bank AG more than a decade earlier and spoke of the trust and respect they had developed since, according to a summary shared internally. "We are family,” Son said.

But behind the smiles and talk of kinship, another story is unfolding, one about the perplexing relationship at the top of SoftBank. The Vision Fund last week reported a loss for the latest fiscal year of $17.7 billion as it wrote down the value of portfolio companies including WeWork and Uber Technologies Inc. That triggered the biggest loss in SoftBank’s 39-year history. Its shares have been hammered as investors fret that the virus will batter the company’s holdings even more, and Son has said he will sell $42 billion in assets.

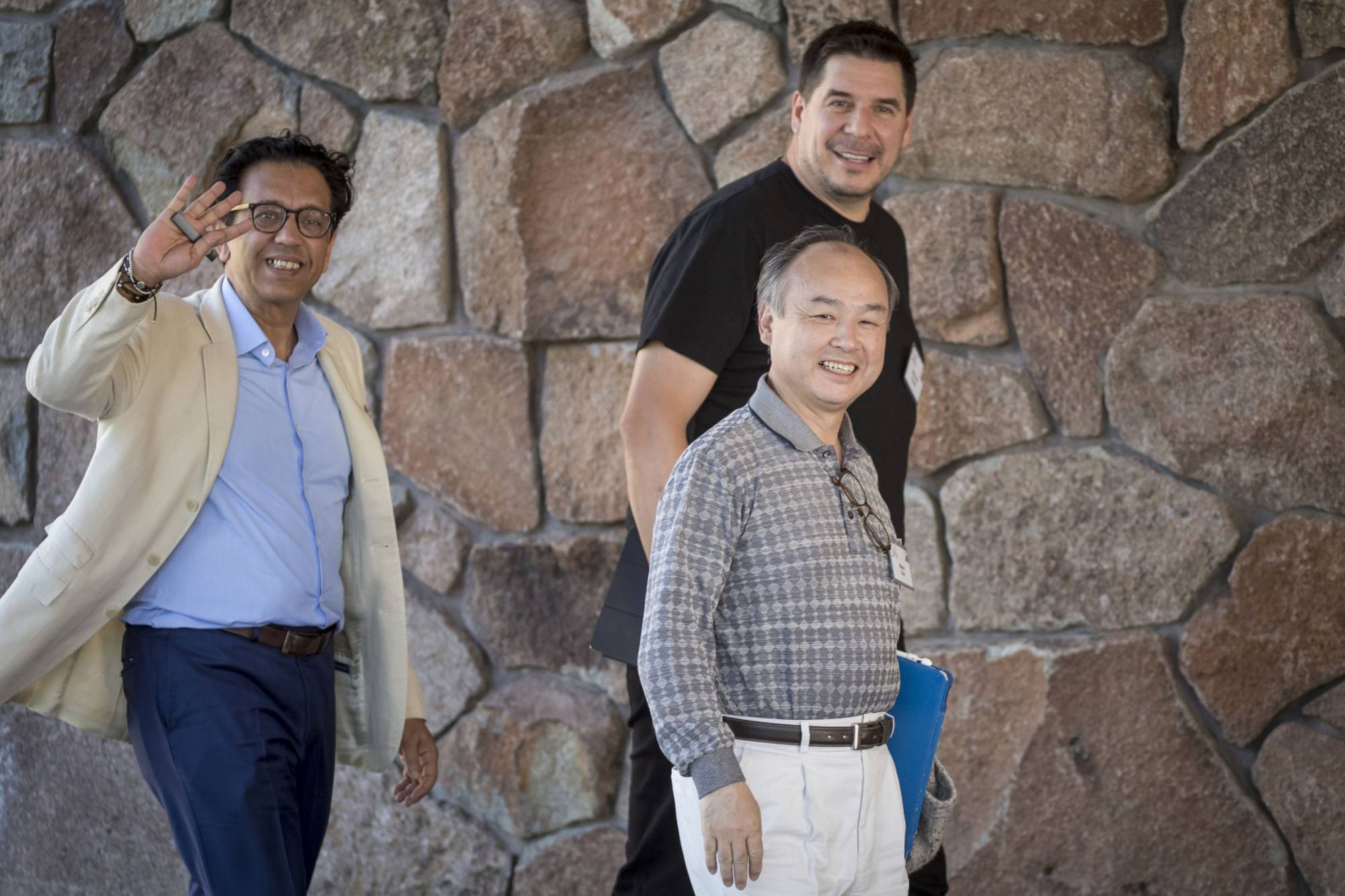

Misra is at the heart of the problem in ways that go beyond how the fund’s companies are performing, people familiar with the matter say. He has come under fire for alleged efforts to tarnish internal rivals, including a previously undisclosed clash with SoftBank Chief Operating Officer Marcelo Claure. The company has acknowledged that it is conducting an internal review. At the same time, Elliott Management Corp., the activist investment fund that built up an almost $3 billion stake in the company, has asked SoftBank to name three independent directors and create a new board committee to improve the Vision Fund’s investment process, according to correspondence reviewed by Bloomberg News.