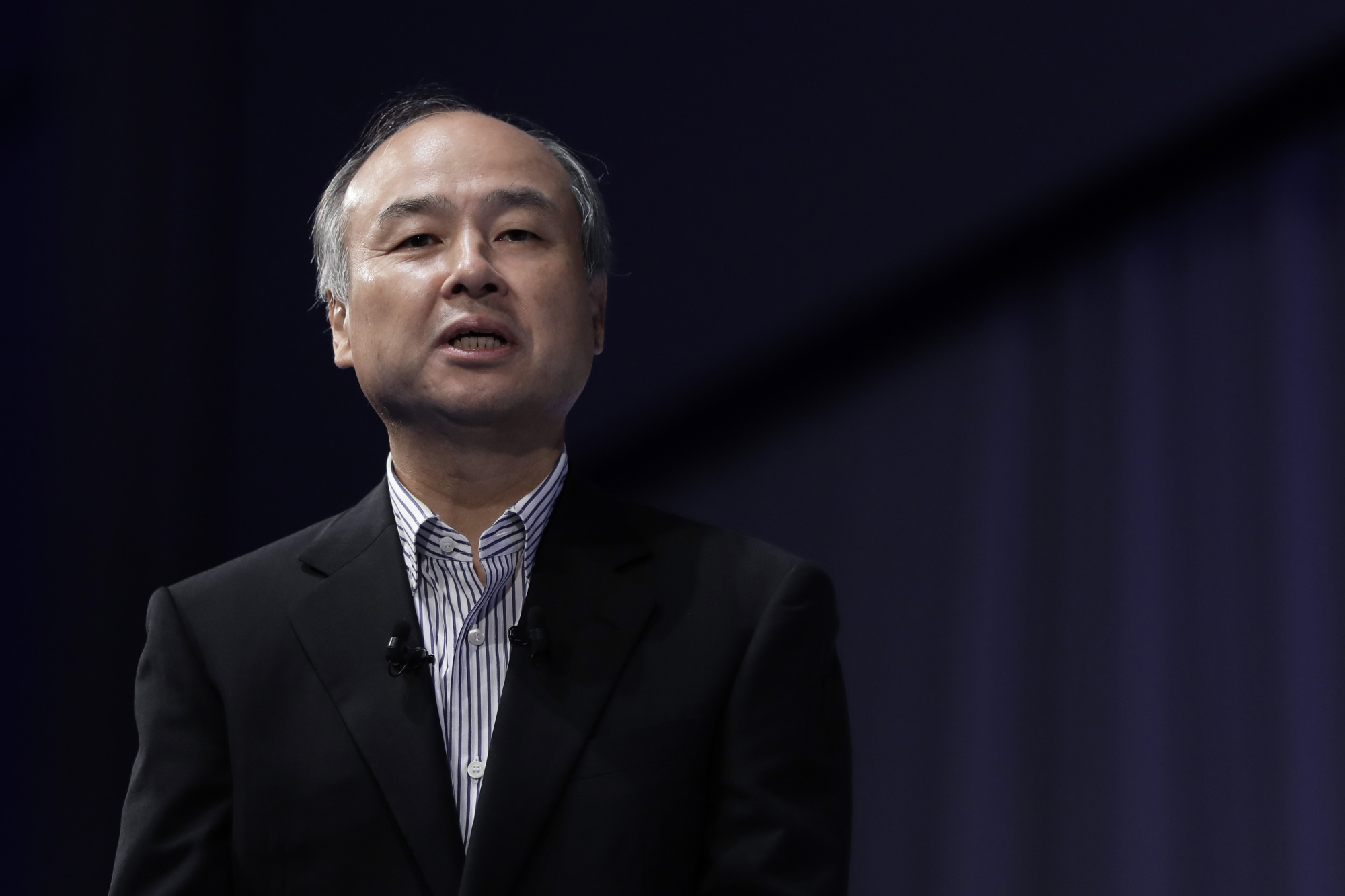

Masayoshi Son plans to use SoftBank Group Corp. in a direct bid for Charter Communications Inc. after an earlier merger proposal by its U.S. wireless unit was rejected, according to a source familiar with the matter.

Son plans to make the offer this week, the source said, asking not to be identified ahead of a public announcement. The plan isn't complete and could change, the source said. Charter spurned an offer to merge with Sprint Corp., which is controlled by SoftBank.

The plan by Son, SoftBank's chairman, could reignite deal talks that had appeared to be dead late Sunday, when Charter said it wasn't interested in buying Sprint.