While Takata Corp.'s bankruptcy filing appears to have it on course to someday regain financial stability, questions remain about the turnaround as the company still faces potential additional costs from recalls and litigation.

Takata filed for bankruptcy protection Monday with liabilities estimated at well over ¥1 trillion, the largest bankruptcy by a Japanese manufacturer in the postwar period.

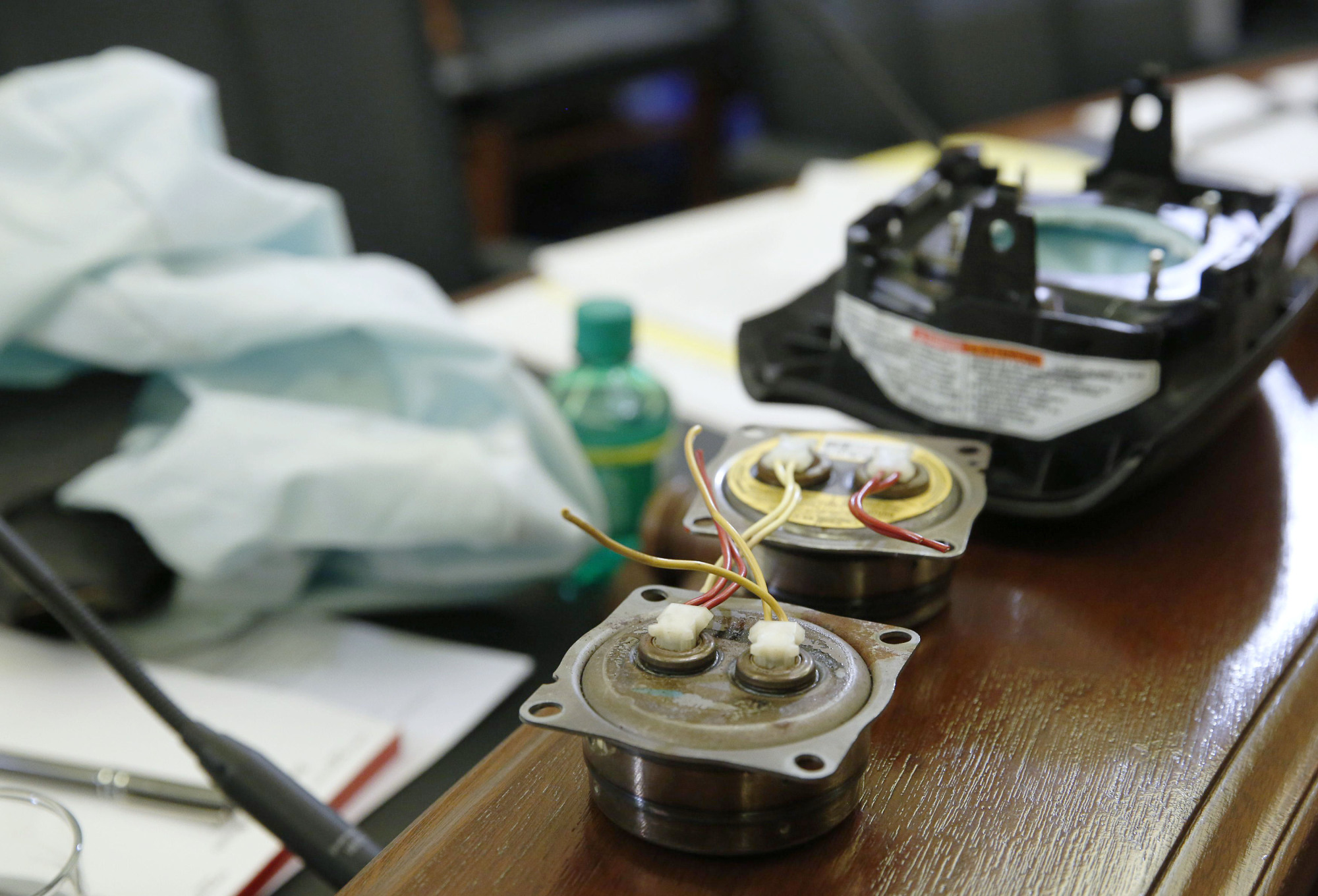

The auto parts supplier is in the midst of a global recall of faulty air bag inflators that have affected 42 million vehicles across 19 automakers and are linked to at least 11 deaths in the United States alone.