SoftBank Group Corp. said Thursday its sale of Alibaba Group Holding Ltd. stock will raise $8.9 billion, an infusion of cash that can be used to strengthen the company's balance sheet and allow it to act fast when making strategic investments.

Alibaba is paying $74 a share to buy back $2 billion of its own stock from SoftBank, which will also sell stakes worth $500 million apiece to two state-owned investment firms in Singapore at the same per-share price, Alibaba and SoftBank said. Another $400 million of shares will go to the Alibaba Partnership of senior executives. The total amount raised is $1 billion more than what SoftBank announced a day earlier.

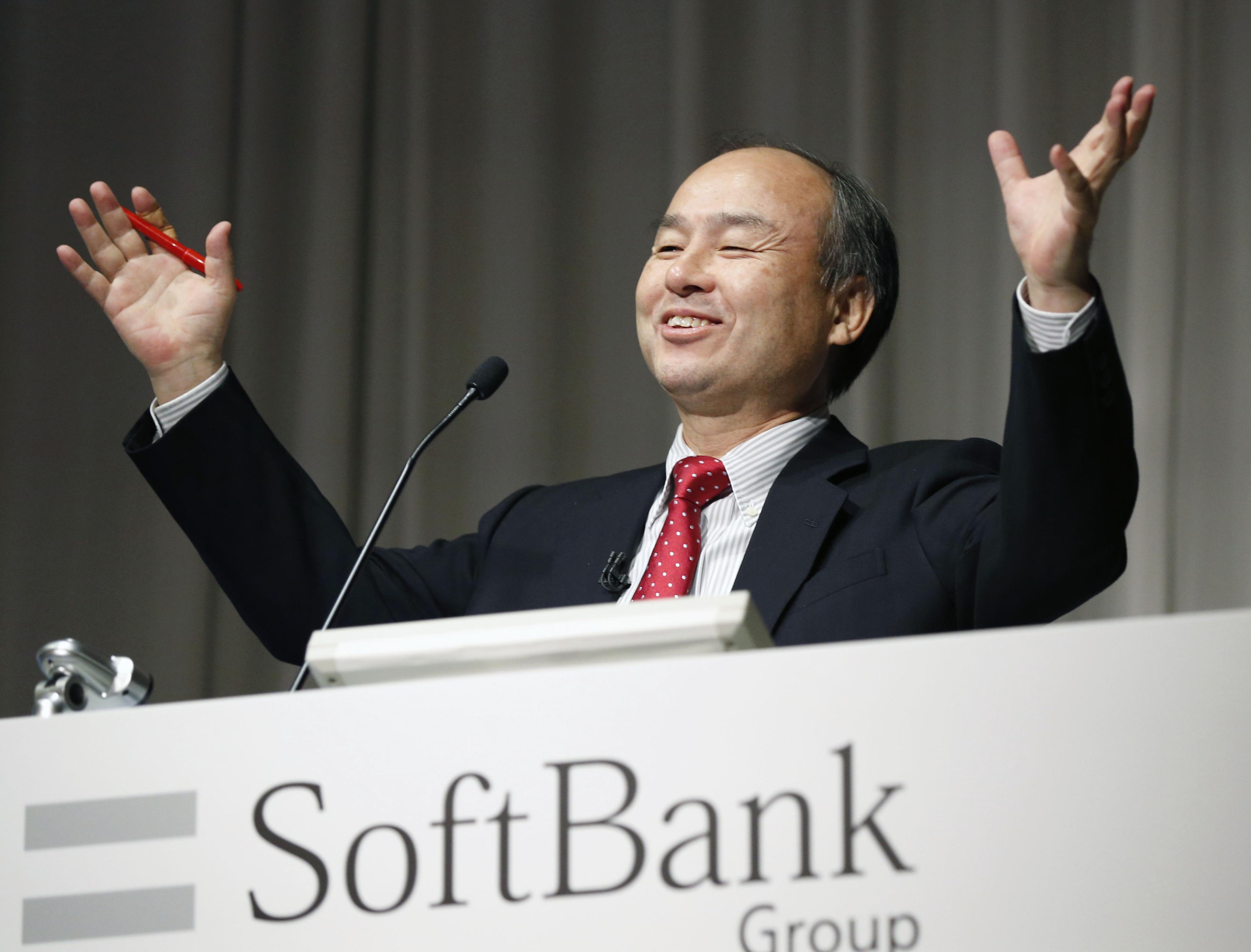

SoftBank is selling Alibaba shares for the first time in 16 years as it looks to step up investments in promising startups and strengthen its balance sheet, which includes a debt load of ¥11.9 trillion. President Nikesh Arora is leading an effort to re-examine the technology company's portfolio that will probably include further asset sales, a person familiar with the matter has said.