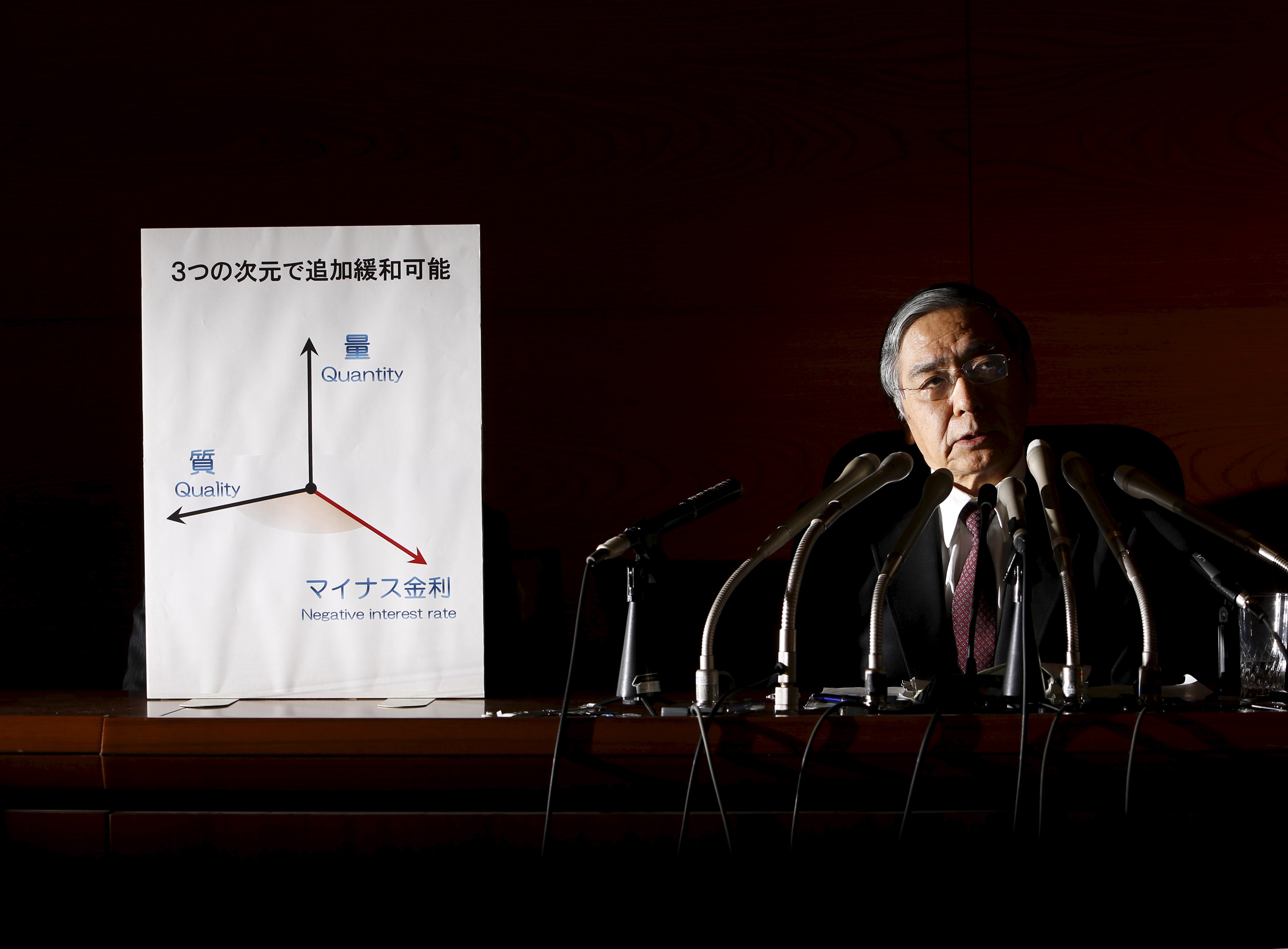

The yen dropped the most in more than a year after Bank of Japan Gov. Haruhiko Kuroda unexpectedly adopted negative interest rates, risking another round of competitive devaluations.

The currency fell against all 16 of its major peers after the central bank voted 5-4 to apply an interest rate of minus 0.1 percent to current accounts held at the central bank. The surprise move prompted Morgan Stanley to remove its yen trading strategies for now, according to a research note from the bank.

The Bank of Japan's decision halted a yen rally that threatened to be the strongest since Kuroda took office in 2013, and sent shock waves through currency markets. The move raises the specter of further easing by other central banks that also stand to benefit from weaker domestic currencies as they battle to stimulate growth and inflation. Officials in the euro area, Switzerland and Sweden have already lowered their deposit rates below zero, and the European Central Bank has promised to reconsider monetary policy again in March.