Late last month, Japan hosted its third International Conference on Fuel Ammonia as part of a series of events promoting the shift to clean energy. Speakers included officials from the industry ministry, the International Energy Agency and representatives of industrial giants, from Mitsubishi Corp. to Aramco, covering topics such as supply chains and decarbonizing the shipping industry.

The conference was another sign of Japan’s unwavering commitment to a climate solution that critics say is far from clean and may not fit the timeline of a world that needs to rapidly reduce emissions.

The government and major industries hope to use ammonia, a gas comprised of nitrogen and hydrogen, on a massive scale to reduce carbon dioxide emissions from coal-fired power plants by replacing a portion of the coal fuel with ammonia in a process known as "co-firing." Ammonia does not emit CO2 when burned, so the amount of ammonia that is co-fired directly correlates with emission reductions at the plant. Equipping an existing coal plant for co-firing does not require major retrofits, allowing utilities to continue using their existing assets.

Like all nations, Japan urgently needs to decarbonize its energy sector; coal, the dirtiest fossil fuel, accounted for 27.8% of the country’s energy mix in 2022. The government’s current energy plan aims to lower coal’s share to 19% by 2030, despite calls from the United Nations and environmental organizations for OECD countries to stop all use of coal by then. The same energy plan foresees ammonia, together with hydrogen, providing 1% of Japan’s energy needs by 2030.

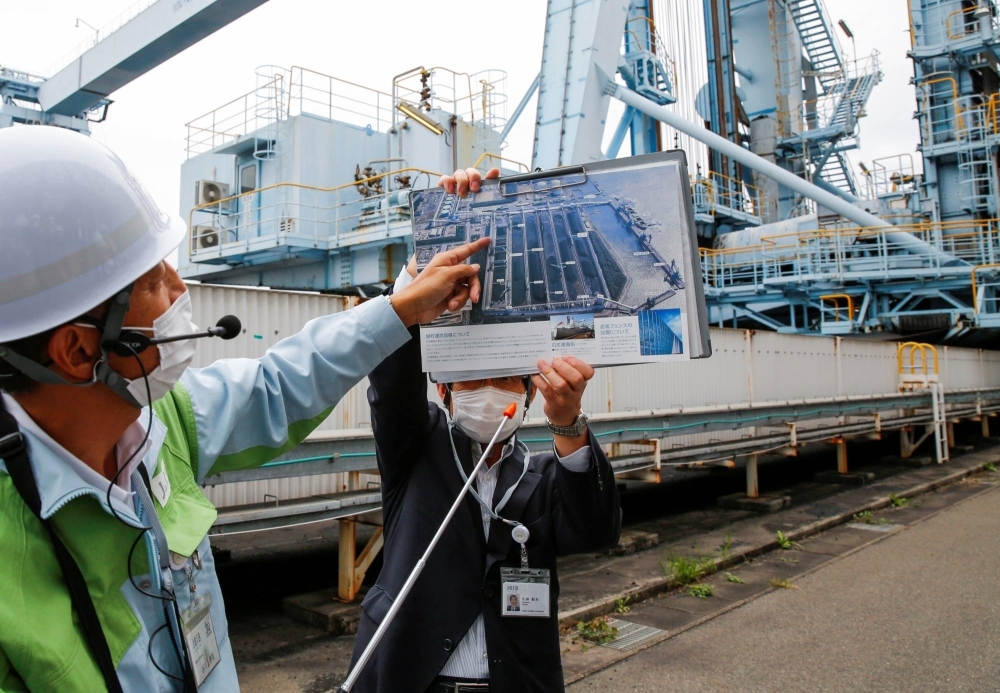

Burning ammonia for power generation appears technically feasible — albeit costly — but has yet to be widely implemented. This year, Japanese utility JERA is testing a 20:80 ammonia-to-coal co-firing ratio at a unit of its Hekinan Thermal Power Station in Aichi Prefecture. JERA aims to gradually increase the co-firing percentage over time, with the ultimate goal of 100% ammonia combustion becoming available by 2050, while the government’s transition roadmap aims for either dedicated combustion or co-firing combined with carbon capture and storage (CCS) technology by that year.

But as the government and companies rush to establish supply chains that will feed them fuel ammonia from around the world, climate policy and air pollution experts are questioning whether ammonia really is a clean fuel that can aid Japan’s decarbonization.

Their environmental concerns are twofold. First, current ammonia production emits significant amounts of CO2, meaning that simply replacing coal with ammonia may not contribute to reducing overall CO2 emissions. Second, air pollution across the ammonia supply chain could damage the health of both humans and ecosystems.

CO2 reductions in doubt

Although ammonia doesn’t emit CO2 when burned, ammonia production requires significant amounts of energy. The ammonia industry accounts for 1.3% of global CO2 emissions.

Experts use a system of colors to categorize ammonia based on how much CO2 was emitted in its production. The three major categories are: “gray” ammonia produced using fossil fuels, specifically natural gas; “blue” ammonia produced using fossil fuels but with 80–90% of the CO2 emissions captured by CCS technology; and “green” ammonia produced using renewable energy.

In recent years, the Japanese government and corporations have announced a flurry of partnerships and feasibility studies for fuel ammonia with counterparts overseas.

Mitsui & Co., Marubeni and various Japanese utilities are exploring ways to produce blue ammonia in Australia. Marubeni is also looking to develop a blue ammonia supply chain from Canada.

Heavy industry manufacturer IHI, shipping company Mitsui O.S.K. Lines, and oil company INPEX collaborated on a demonstration project for producing and shipping blue ammonia from the United Arab Emirates. JERA, too, agreed to work on ammonia with a UAE state-owned oil and gas company. In Saudi Arabia, the Japanese government and Japanese firms are also backing a blue ammonia project with fossil fuel giant Aramco.

Blue ammonia relies on CCS technology to reduce its CO2 emissions, but CCS is expensive, not widely used, and many of the world’s existing CCS projects have underperformed. A report by Japanese think tank Climate Integrate argued that “even if CCS becomes feasible in practice, carbon capture rates would reportedly still be around 80% to 85%, which means that zero emissions would still not be possible.”

“From my understanding of the data accessible, the majority of projects producing ammonia are from fossil fuels,” said Kimiko Hirata, Climate Integrate’s executive director. In her view, CCS is “just an excuse” for continuing to produce ammonia with gas.

Still, a few of the ammonia projects in development are green. In Malaysia, IHI partnered with a Petronas subsidiary for a green ammonia feasibility study, and Sumitomo Corp. is collaborating on green ammonia with a power producer in Chile.

All the ammonia Japan currently imports, however, is gray, as blue and green ammonia are not yet mass produced, according to Motoichi Kato, deputy secretary-general for the Clean Fuel Ammonia Association (CFAA), an industry group whose members include virtually all of Japan’s major stakeholders involved in fuel ammonia.

“From around 2027, the imported fuel ammonia will be blue rather than gray,” Kato wrote by email. Although a CFAA roadmap shows the percentage of green ammonia increasing over time, “the ratios for blue and green are fluid, depending on how much each will cost,” he explained.

However, even green ammonia could emit a greenhouse gas — nitrous oxide (N2O) — if not burned properly. More potent than CO2, N2O can be emitted if ammonia combustion is slow and incomplete, a challenge Japanese industrialists are looking to address.

Pollution across the supply chain

In addition to concerns about ammonia’s lifecycle greenhouse gas emissions, experts question how producing and burning such large quantities of ammonia — Japan will require an estimated 3 million tons by 2030 and 30 million tons by 2050 — could impact air and water quality.

Climate Integrate warns that fixing nitrogen from the atmosphere to produce ammonia may further unbalance the world’s nitrogen cycles. Increased nitrogen can lead to eutrophication of marine ecosystems, as well as air pollution and groundwater contamination.

In order to mitigate the CO2 emissions generated from shipping ammonia, Japanese companies are working to develop ammonia-fueled ships to ferry their precious cargo. However, fuelling ships with ammonia produces its own emissions and associated environmental risks, according to a recent report by the Denmark-based Maersk Mc-Kinney Moller Center for Zero Carbon Shipping.

First, ammonia slip — the escape into the atmosphere of unburnt ammonia, which is toxic — is a safety risk for the crew on board the vessel as well as for local communities and environments along shipping routes. Second, it would also produce nitrogen oxides, air pollutants that can impact human health and the environment. Still, the center concluded that pollution management is possible with innovation and emission treatment technologies.

Potential air pollution from ammonia combustion in Japan’s coal plants is hotly debated.

Researchers from the Finland-based Centre for Research on Energy and Clean Air (CREA) used data from JERA’s Hekinan plant and other scientific studies to estimate the amount of PM2.5 — fine particulate matter that can have a severe impact on human health — and PM2.5 precursor gases would be produced from co-firing ammonia.

Even using conservative emissions estimates, they found that lifecycle air pollution increased by 67% when ammonia was used at a 20% co-firing ratio and by 167% at a 50% co-firing ratio, with ammonia gas emissions from shipping and combustion accounting for most of the increase.

JERA has publicly responded to the CREA report, which was published in May, insisting that “ammonia co-firing does not increase air pollutants.” The company supported its claims with the results of a 20% ammonia co-firing test, conducted in 2019 at a test facility, in which no ammonia was released outside the site. In addition, JERA stated it either uses unburnt ammonia as a pollutant-reducing agent, thereby fully consuming it, or it is cleansed from equipment at the plant with water.

CREA air quality analyst and report co-author Jamie Kelly noted that air pollution from co-firing still poses a risk to human health even if pollution stays at the same level as that from 100% coal-fired power plants. In Japan, PM2.5 leads to an estimated 43,000 premature deaths each year, and coal-fired power plants contribute 12% of the country’s PM2.5 concentration, according to data from State of Global Air.

Transitioning to renewable energy would curtail many of those deaths, Kelly said. Although experts on air pollution, health and ecosystems have a strong awareness of ammonia’s potential risks, “I do not see these people or these arguments involved” in discussion of ammonia as an alternative energy, he added.

The CFAA’s Kato wrote that pollution from co-firing shouldn’t be a concern because national and local laws already set strict limits for pollutants (including the N2O emissions discussed above), which co-firing technology is being designed to meet. The organization’s website makes similar claims about smokestack emissions but admits that stray ammonia emissions during production are “unavoidable,” though it says that will only account for 0.001% of emissions.

Expansion overseas

Japan hopes to expand the use of fuel ammonia overseas as well, particularly in Asia. JERA, for example, is undertaking co-firing feasibility studies with local partners in the Philippines, Thailand and Malaysia. IHI and Mitsubishi Heavy Industries are studying ammonia co-firing technology with Indonesian state utility PLN.

However, dozens of environmental groups in these countries and elsewhere have rejected ammonia as a transition fuel. They cite findings by data-driven climate policy nonprofit TransitionZero that say even a 50% co-firing ratio would still barely bring coal plants’ CO2 emissions on par with those of natural gas plants in the region.

Across Asia, utilities will need to adjust their planning from baseload fossil fuels, which they favor as a stable power supply, to intermittent renewable energy in order to meet their net zero targets, said Isabella Suarez, an engagement analyst with TransitionZero. “It just makes more sense to start that transition, rather than hold on to these (fossil fuel) technologies,” she added.

Suarez acknowledged that fuel ammonia could become useful in difficult-to-decarbonize industrial sectors closer to 2050, once an abundance of renewable energy makes green ammonia more readily available.

In the short term, climate experts are skeptical of ammonia’s utility.

The power sector must be rapidly decarbonized to meet international net zero targets, Hirata emphasized. “How can this technology be compatible with that speed?”