One of the chipmaking industry’s small but indispensable suppliers is sinking deeper in debt because it is refusing to raise prices to cover mounting capital spending costs.

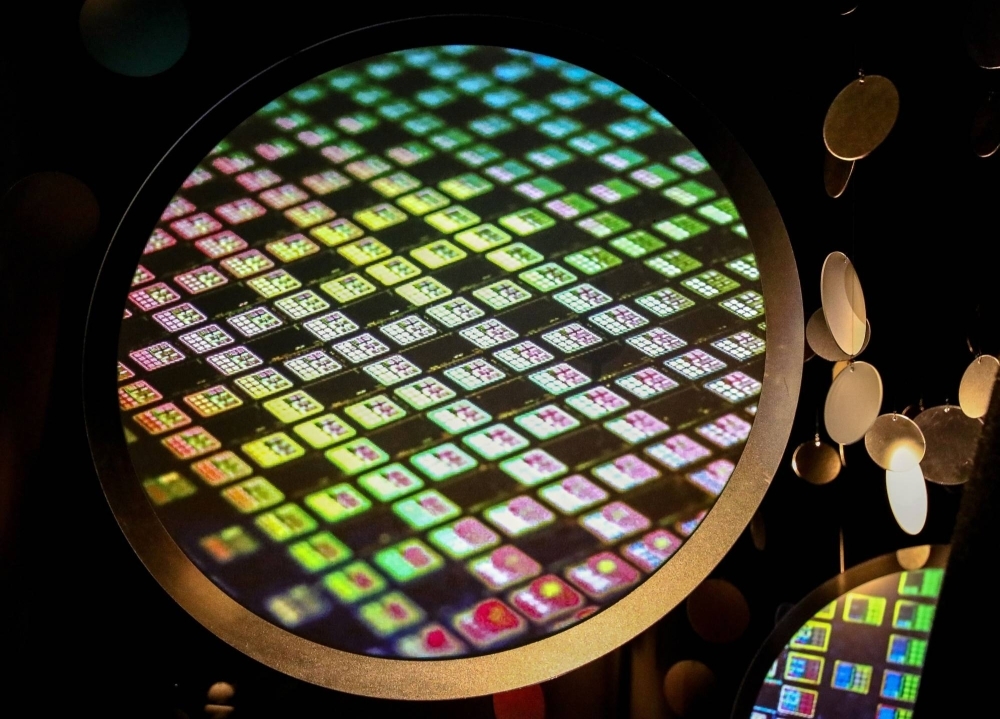

Osaka-based Fuso Chemical is bearing the cost to help churn out bigger volumes of sophisticated chips without asking customers for more. That’s despite holding a more than 90% share of the world’s silica used to polish silicon wafers and counting deep-pocketed heavyweights Taiwan Semiconductor Manufacturing Co., Samsung Electronics and Intel as customers.

At issue is a deep-seated fear among suppliers about risking yearslong relationships with big clients and creating openings for new technological workarounds. In addition to that power dynamic, Japanese suppliers also contend with decades of deflation that has weighed down domestic customers’ end prices.