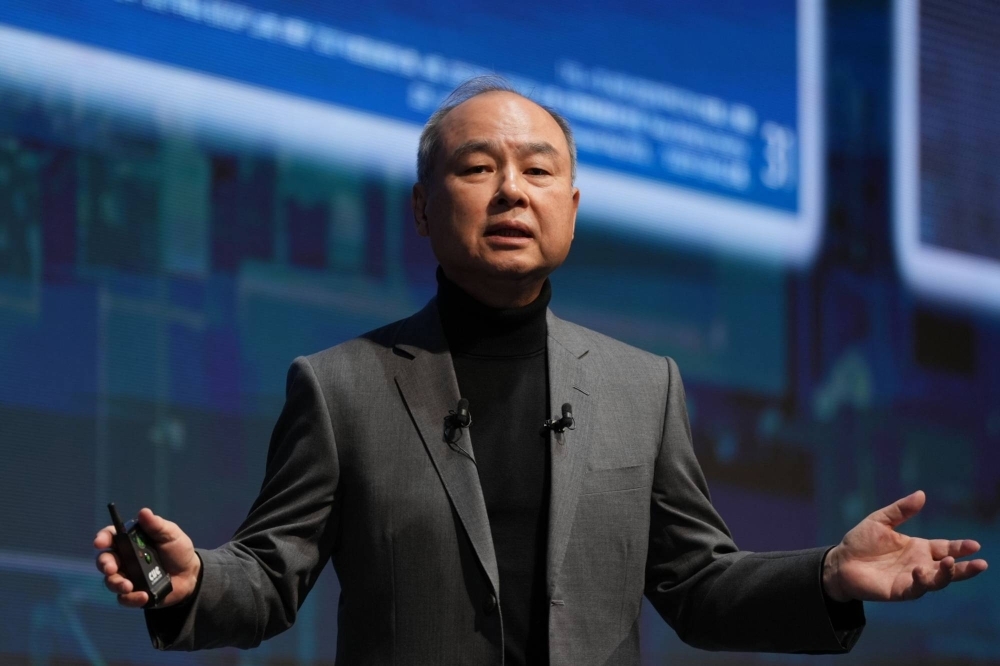

WeWork's bankruptcy filing caps a yearslong saga that revealed breathtaking flaws in the investment style of Japanese billionaire Masayoshi Son, damaging his professional reputation far beyond the money he lost.

Son overrode his lieutenants’ objections and handed WeWork founder Adam Neumann billions of dollars from both SoftBank Group and the Vision Fund, lifting the co-working office space’s valuation to an astronomical $47 billion in early 2019. Just months later, investors balked at the deep losses and conflicts of interest WeWork’s IPO filings revealed.

WeWork’s subsequent nosedive is costing SoftBank more than the estimated $11.5 billion in equity losses and another $2.2 billion in debt still on the line. WeWork’s very public decline, along with the Vision Fund’s record loss of $32 billion last year, battered Son’s standing as a shrewd investor who scored one of venture capital’s legendary wins through an early bet on Chinese e-commerce leader Alibaba.