Vigorous streamlining efforts paid off for Panasonic Corp. and Sharp Corp., two of Japan's three major electronics firms, in fiscal 2013, but Sony Corp. struggled to rebuild as its mainstay businesses continued to lose money.

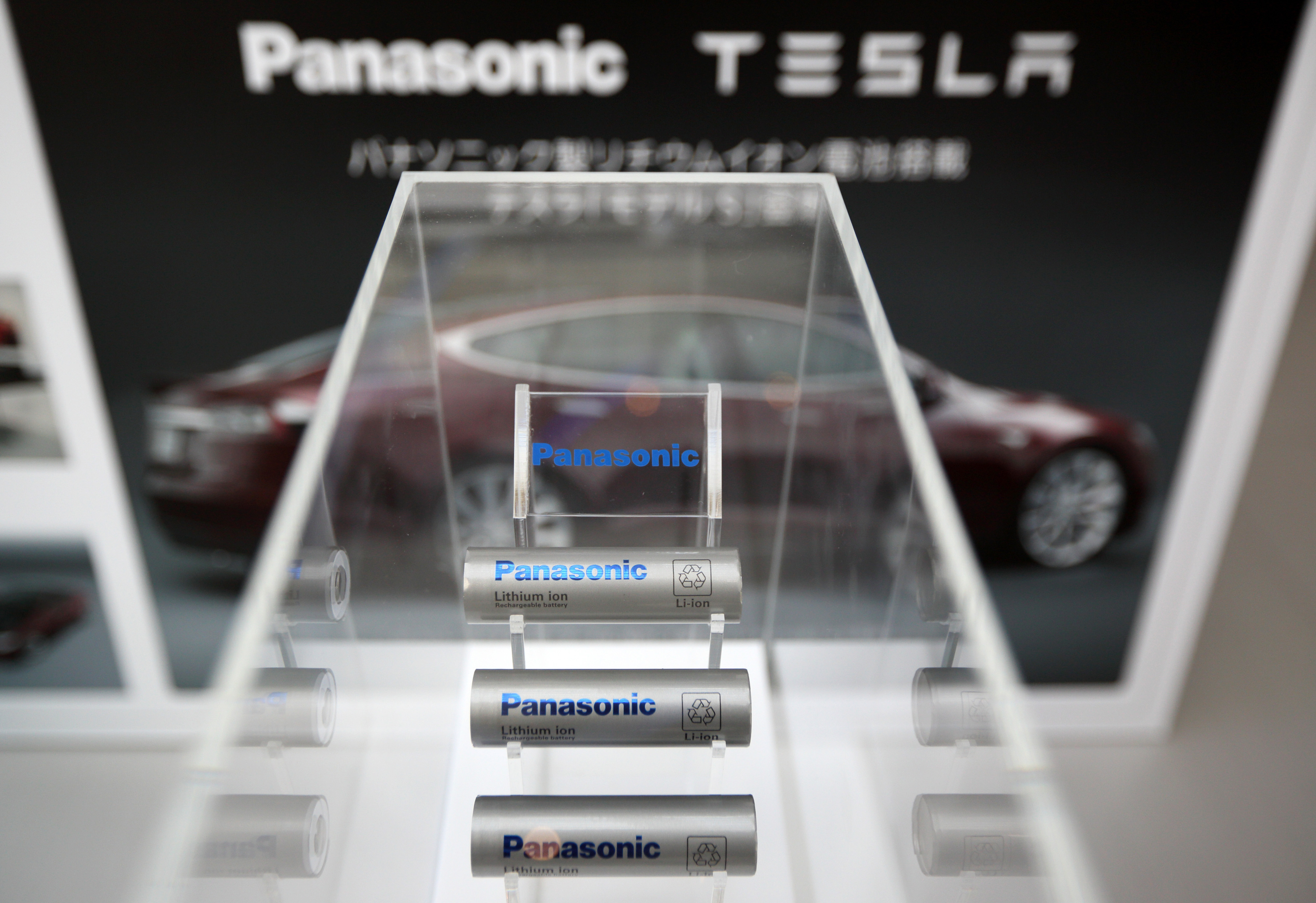

Thanks to drastic cost-cutting efforts and a restructuring of its business portfolio, Panasonic managed to secure a net profit for the first time in three years and exhibited some signs of resiliency.

Sharp also earned its first net profit in three years, thanks to streamlining operational costs and steadily improving sales of solar cells and small and midsize LCD panels for smartphones and tablets.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.