Just before the New Year holiday in Japan, ads for a smartphone game called Granblue Fantasy began appearing on television and in magazines.

Granblue was already huge in Japan with more than 7 million people downloading it to fly giant airships and battle an evil empire with swords and magic. Cygames Inc., the company that makes the game, also told people about a new promotion: For a limited time, it would be easier to win a few characters, including one named Anchira.

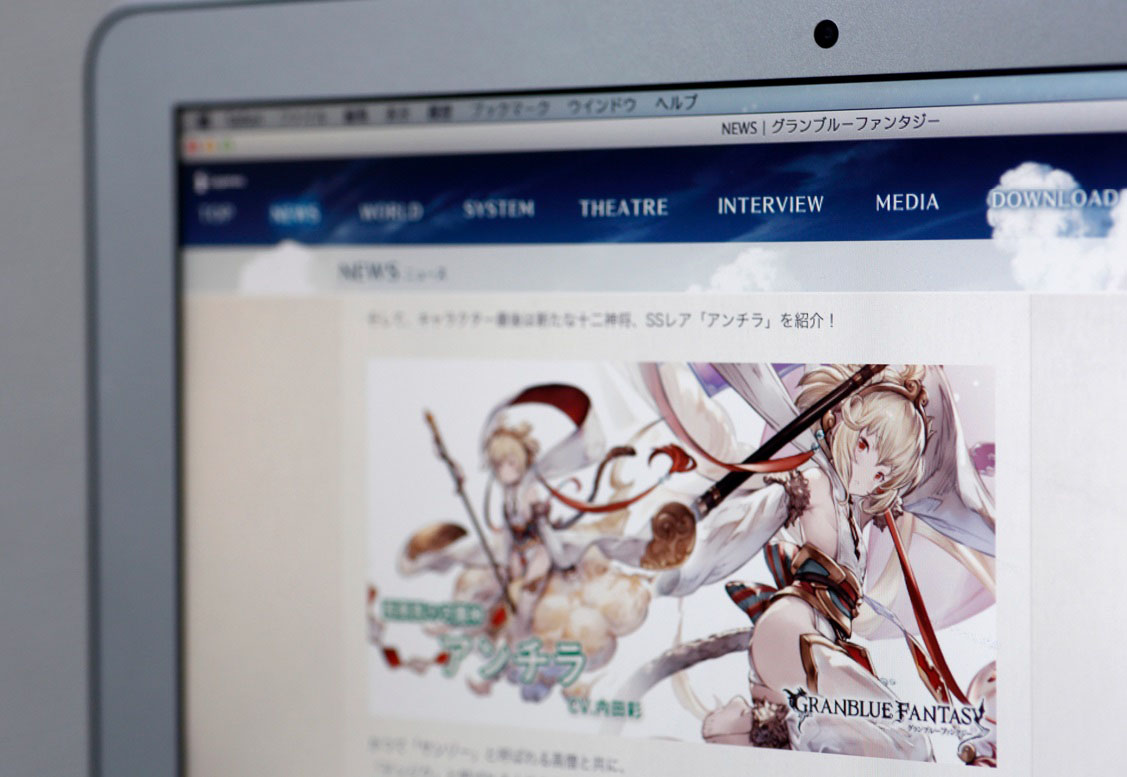

Anchira is a rarely-seen, much-sought-after ally: blonde, scantily-clad, big-eyed. She's the kind of partner that can mean the difference between victory and defeat because of special healing powers. Players can win access to her with mysterious crystals that cost ¥300 apiece and then cracking them open to find out what is inside. Sometimes they contain valuable characters like Anchira; other times they hold weapons or armor. Under normal circumstances, there is a 3 percent chance of locating rare characters like Anchira, but for the week Cygames was running its promotion, the chances would double.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.