According to the "third-party committee" of outside experts appointed by Olympus to investigate the accounting scandal recently exposed by its sacked CEO, Michael Woodford, at least some of the company's directors, auditors and employees failed to stop or were even complicit in an ongoing effort to hide massive investment losses dating back to the early 1990s.

We lawyers like to confuse people with words rather than numbers, so I won't even pretend to understand how you conceal red ink by paying eye-popping fees to shadowy Cayman Islands advisers for overpriced acquisitions. One thing that is sure, however, is that the scandal will result in a lot of navel-gazing about corporate governance in Japan. Again.

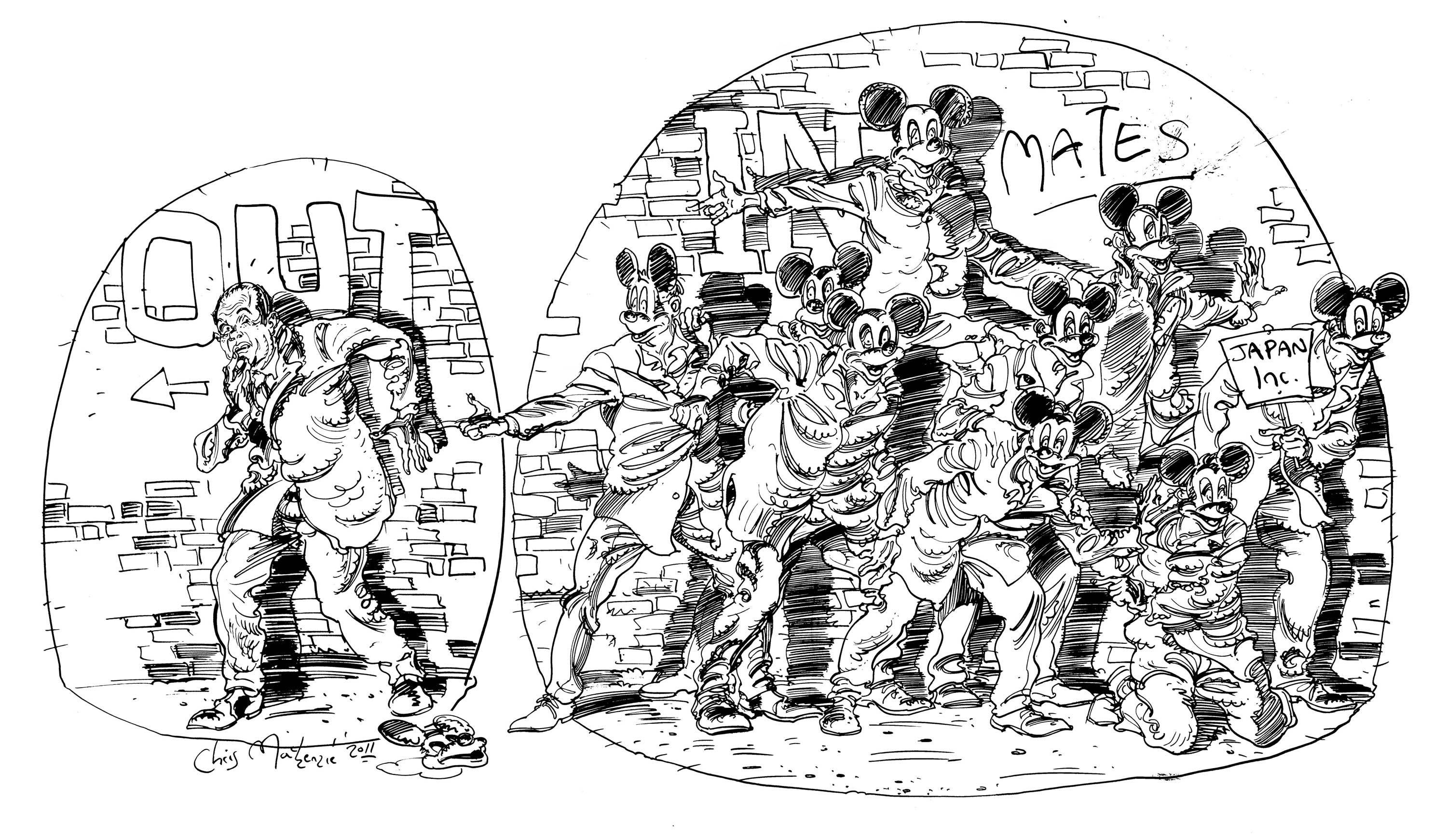

Corporate governance — the rules on how companies should be managed — has long been an issue for foreign investors in Japanese firms. Shares supposedly represent fractional ownership interests in the company that issued them. Yet outsiders who become significant owners of Japanese companies often find themselves given the cold shoulder, not being allowed to appoint directors or otherwise have a say in corporate affairs commensurate with their ownership.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.