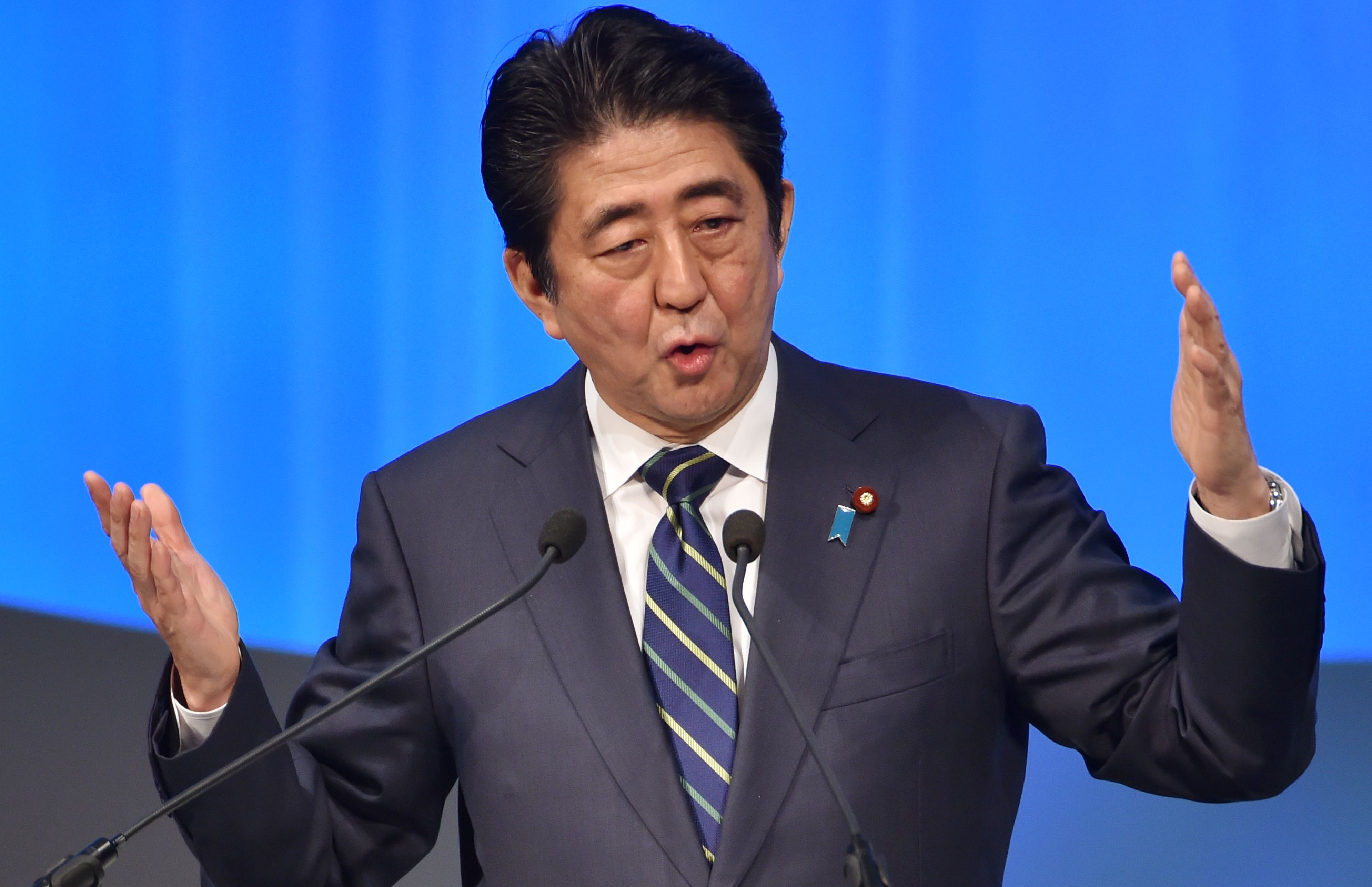

To understand what Prime Minister Shinzo Abe is up against in trying to spring Japan from the deflationary trap stunting its economy, consider the pushback by its most prominent industrialist Akio Toyoda at the wage negotiating table this month.

Toyota Motor Corp. had told its union last week that it would be difficult to increase monthly base wages even by ¥1,000 ($9) — about the price of a bowl of ramen noodles — because global conditions were harsh, its workers were already relatively well-paid and there's been little inflation in Japan, according to people familiar with the negotiations and a labor group newsletter reviewed by Bloomberg News.

That was in response to the union's request for a ¥3,000 raise, which was already smaller than the past two years, when Japan Inc.'s largest company earned record profit.