The Bank of Japan released its first summary of opinions from a monetary policy board meeting Friday, providing an outline of what was discussed at the Dec. 17-18 gathering while giving little new guidance on the future course of monetary policy.

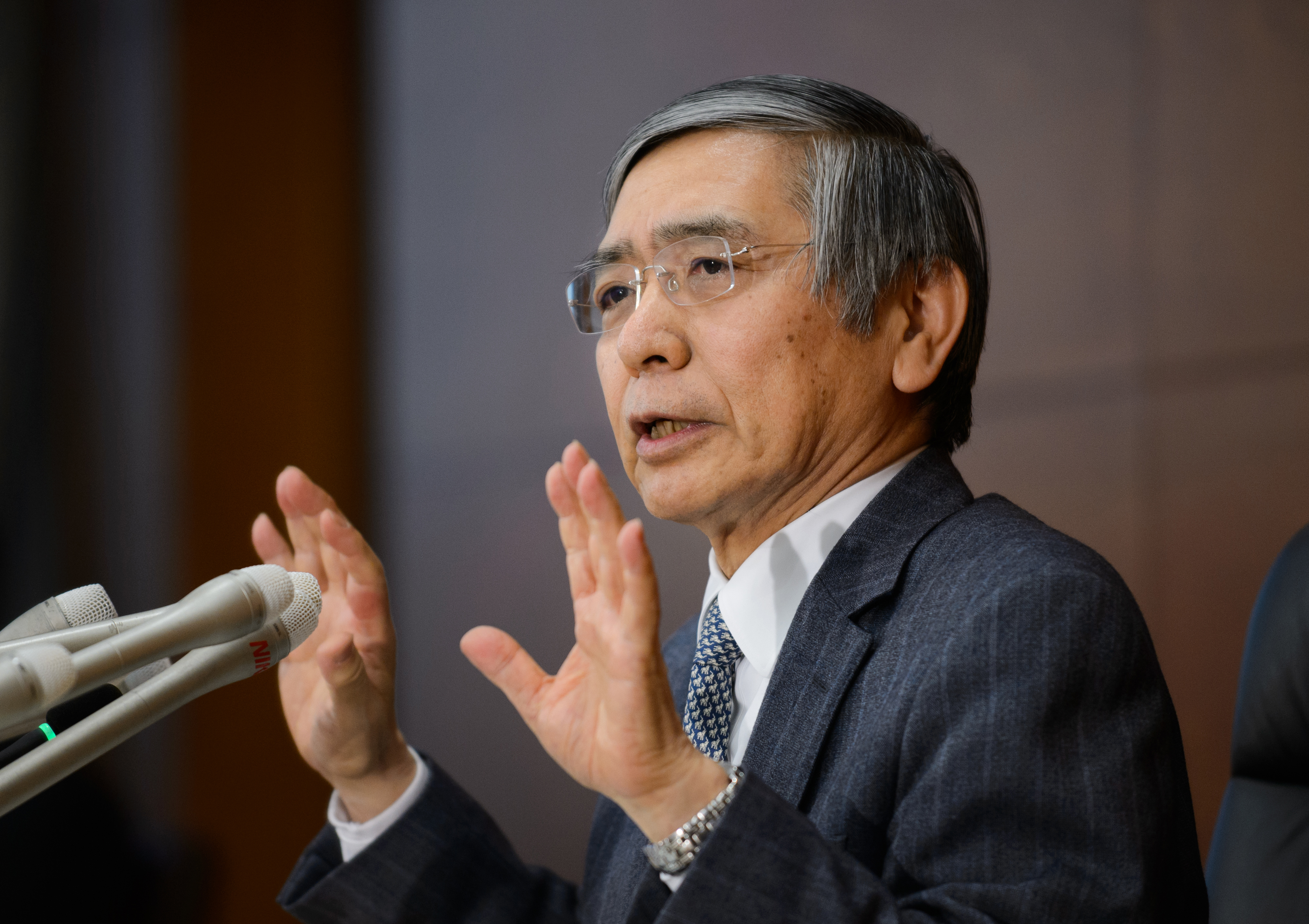

Gov. Haruhiko Kuroda edited a summary of opinions presented by the BOJ's nine board members — who are not identified with their opinions — and by government representatives. The six-page document was laid out in bullet points divided by discussion topics.

One board member said the central bank's "supplementary" monetary easing steps announced last month could make it difficult to communicate its message to the market.