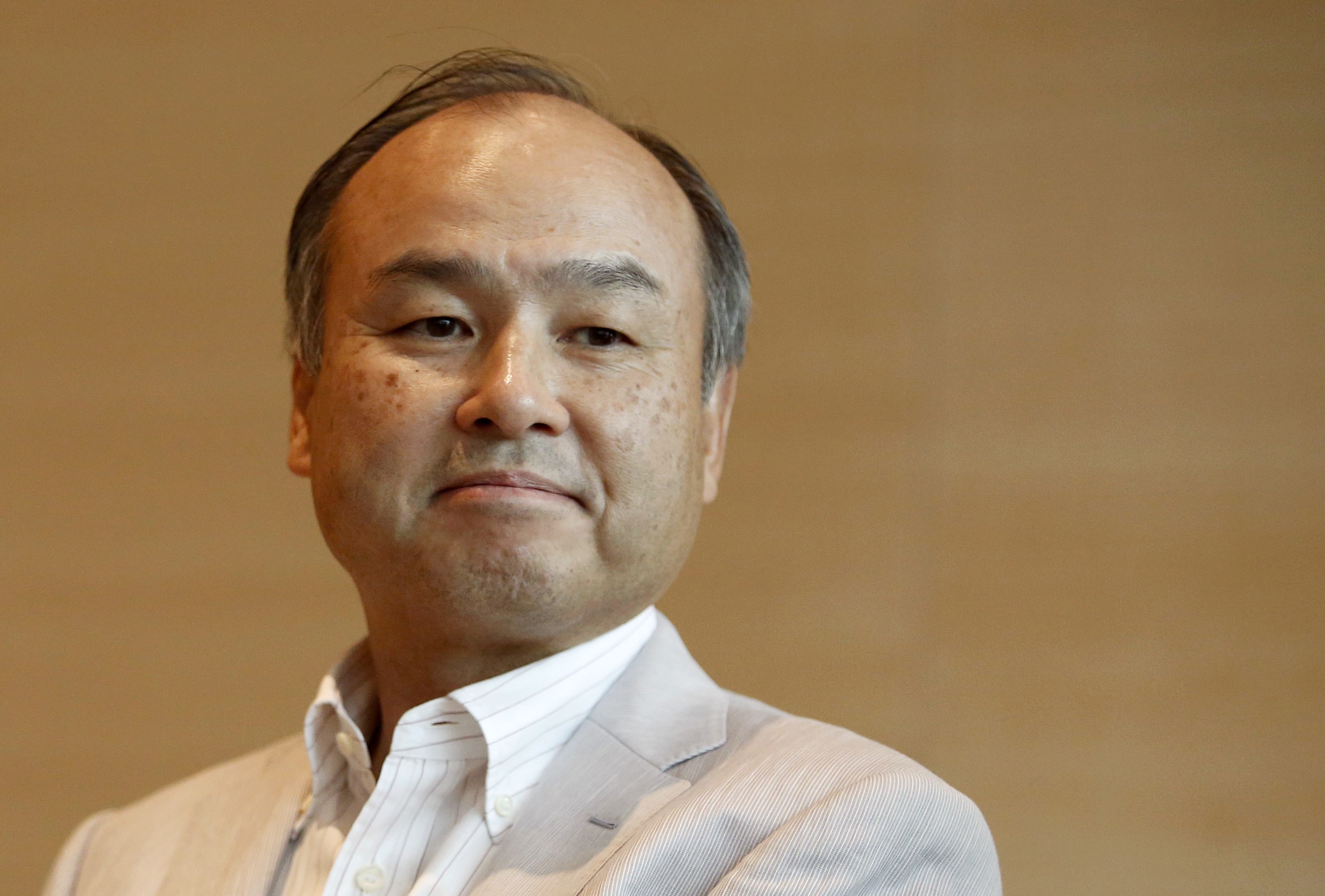

If Masayoshi Son, the billionaire founder and CEO of SoftBank Corp. needs a fresh strategy to fend off a surprise French counterbid for a prized U.S. telecommunications target, he could do worse than ask budding entrepreneurs at the SoftBank Academia.

There, some 300 or so aspiring leaders — split about evenly between company insiders and entrepreneurs from outside — brainstorm ideas and vie to catch Son's eye, with a chance he will offer them a job or invest in their company, or even choose them as his "heir" to run Japan's second-most valuable listed company.

The idea incubator, set up by Son four years ago, meets once or twice a month in the 25th floor cafeteria of SoftBank's Tokyo headquarters.