As emerging space pioneers in China and India race to the moon and Mars, private-sector startups are quietly launching satellites the size of microwave ovens that aim to satisfy much more terrestrial desires.

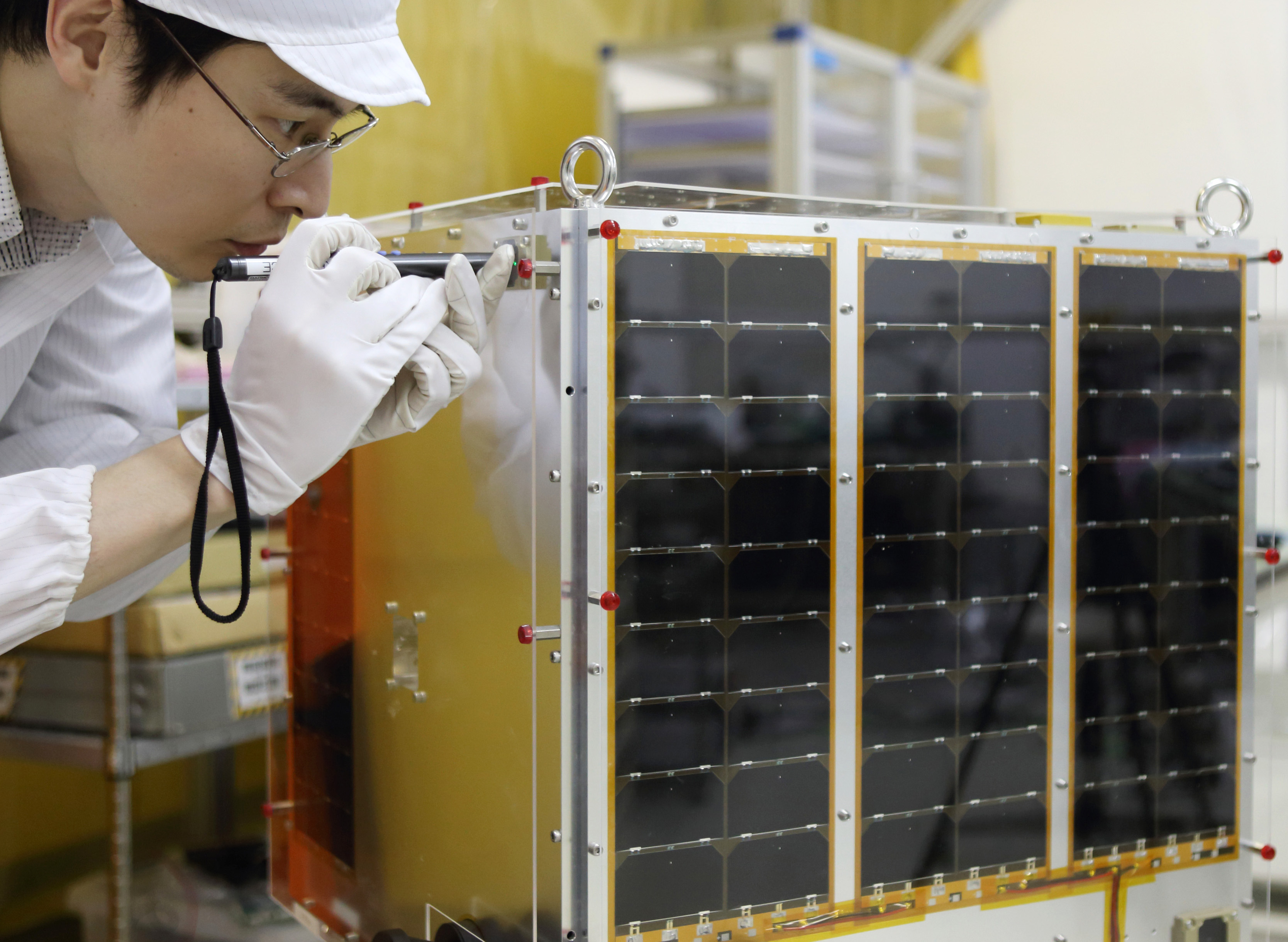

Axelspace Corp. in November launched a micro-satellite from Yasny, Russia, that the Tokyo-based company says will help vessels navigate icebergs in the Arctic. Mountain View, California-based Skybox Imaging Inc. is planning a constellation of 24 orbitals to offer high-definition video of everything from the Somali coastline to Las Vegas traffic.

As governments turn to private investors to fill gaps in their budget-sapping programs, the space race is expanding from $500 million minibus-sized probes used for broadcasting and espionage to machines built from off-the-shelf parts. In Japan, micro-satellites are putting remote-sensing services within the reach of more businesses as Prime Minister Shinzo Abe promotes space development to tap the global wave of commercialization.