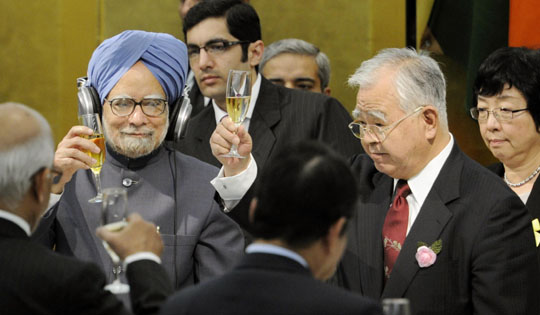

Japan and India struck a bilateral economic partnership agreement Monday, taking a big step toward deepening economic ties.

The accord is expected to encourage Japanese companies to boost investment and exports of auto parts to the rapidly emerging economy.

Analysts also say the agreement may help Japan reduce its heavy reliance on the Chinese market, where tensions have mounted with Beijing in connection with an incident near the Senkaku Islands in the East China Sea.