The consumption tax increase next April will hit every household in Japan hard, with many people's financial future hanging on whether their wages rise enough to offset the impact of the hike, experts say.

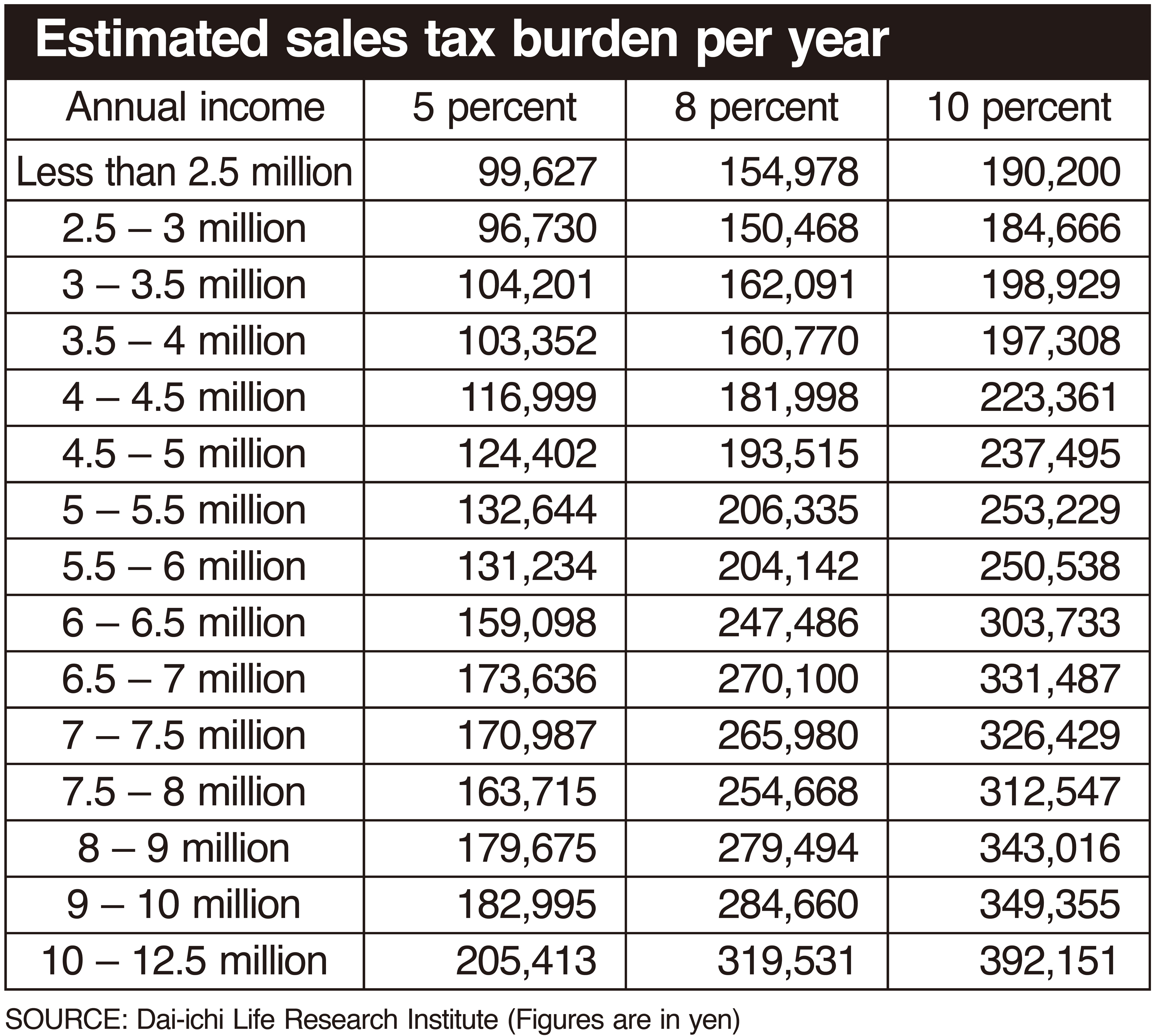

The sales tax hikes — to 8 percent in April 2014 and then to 10 percent in October 2015 — will deal a much heavier blow to individuals and families than the previous tax hike, in 1997, when the rate went to 5 percent, up from 3 percent, according to Rei Tsuruta, manager of the economic research office at Bank of Tokyo-Mitsubishi UFJ.

The ¥5 trillion economic package Prime Minister Shinzo Abe's administration unveiled Tuesday to mitigate the impact of the tax hike is aimed at "spurring corporate business activity so corporations can raise wages, rather than aiding households directly," Tsuruta said.