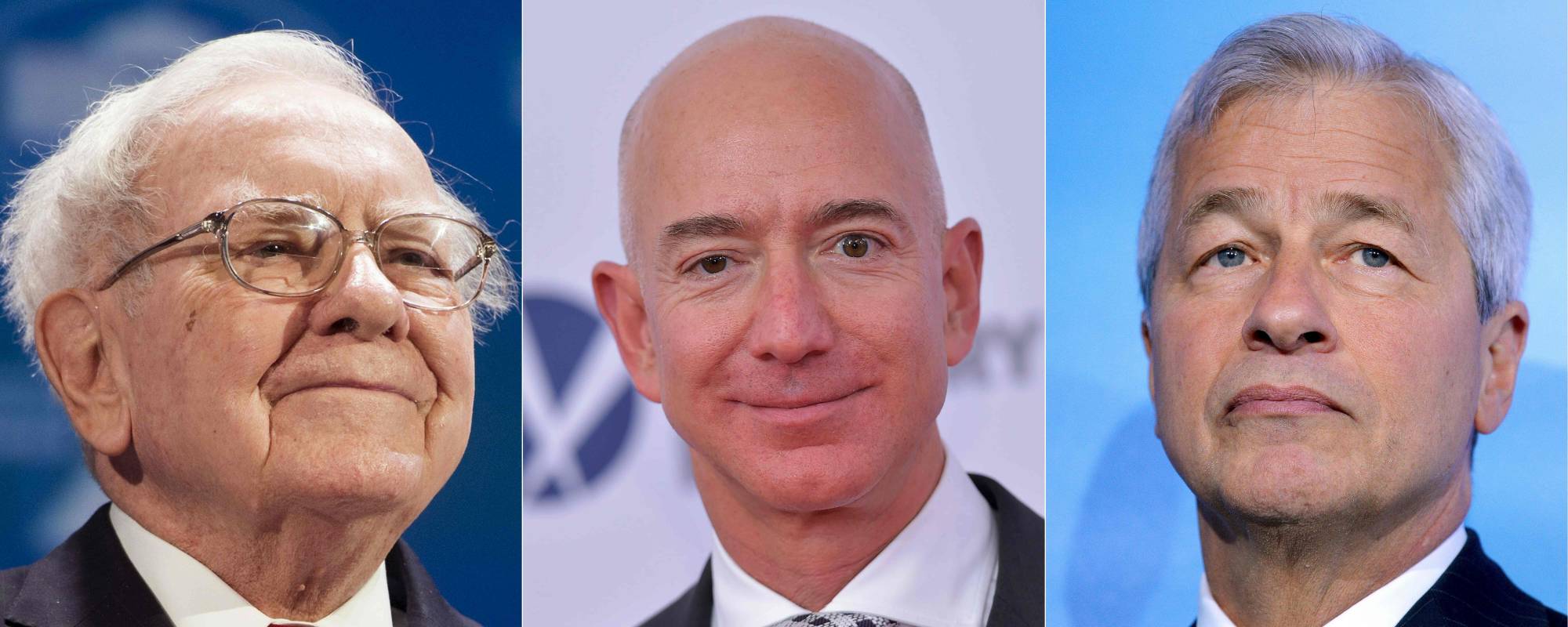

It would be hard to think of a better team than the world’s richest man, one of its top bankers and the most esteemed investor of our time to solve such an elaborate problem as American health care. And yet, not even Jeff Bezos, Jamie Dimon and Warren Buffett could find the answer together.

Haven, the joint venture formed by Bezos’s Amazon.com Inc., Dimon’s JPMorgan Chase & Co. and Buffett’s Berkshire Hathaway Inc., is calling it quits after just three years. It was formed as a platform to discover ways to reduce the mounting costs and frustrating complexities of the health care system, with an initial focus on the companies’ own combined 1-million-or-so workforce. The dissolution of the Haven accord is emblematic of the profound challenge that haunts business leaders and politicians alike, and it comes as health care at large and the deficiencies of the U.S. system have moved front and center during an unprecedented global pandemic.

What began at pre-mask industry run-ins as casual conversations between the three powerful men, during which they’d lament the increasing burden of medical expenses on corporate profits, evolved into a formal partnership in January 2018. With such high-profile names and deep pockets behind it, Haven’s arrival drew much interest and fanfare — and among health care giants, dread — even if its mission was admittedly vague and conveyed a sense of overweening ambition for three nonhealth care companies. With little known or ever publicly disclosed about the venture’s progress since it began, its undoing may not be such a surprise. In May 2019, a candid Buffett said in a television interview that Haven had "no guarantee of success” and that he expected its mission to be "ungodly difficult;” one year later, Haven CEO Atul Gawande stepped aside to focus on the COVID-19 crisis in the more symbolic role of chairman.