Worldwide factory shipments of smartphones last year dropped from the previous year for the first time, signaling a change taking place in the smartphone market, which had been expanding by leaps and bounds since Apple Inc. of the United States launched its first iPhone in 2007.

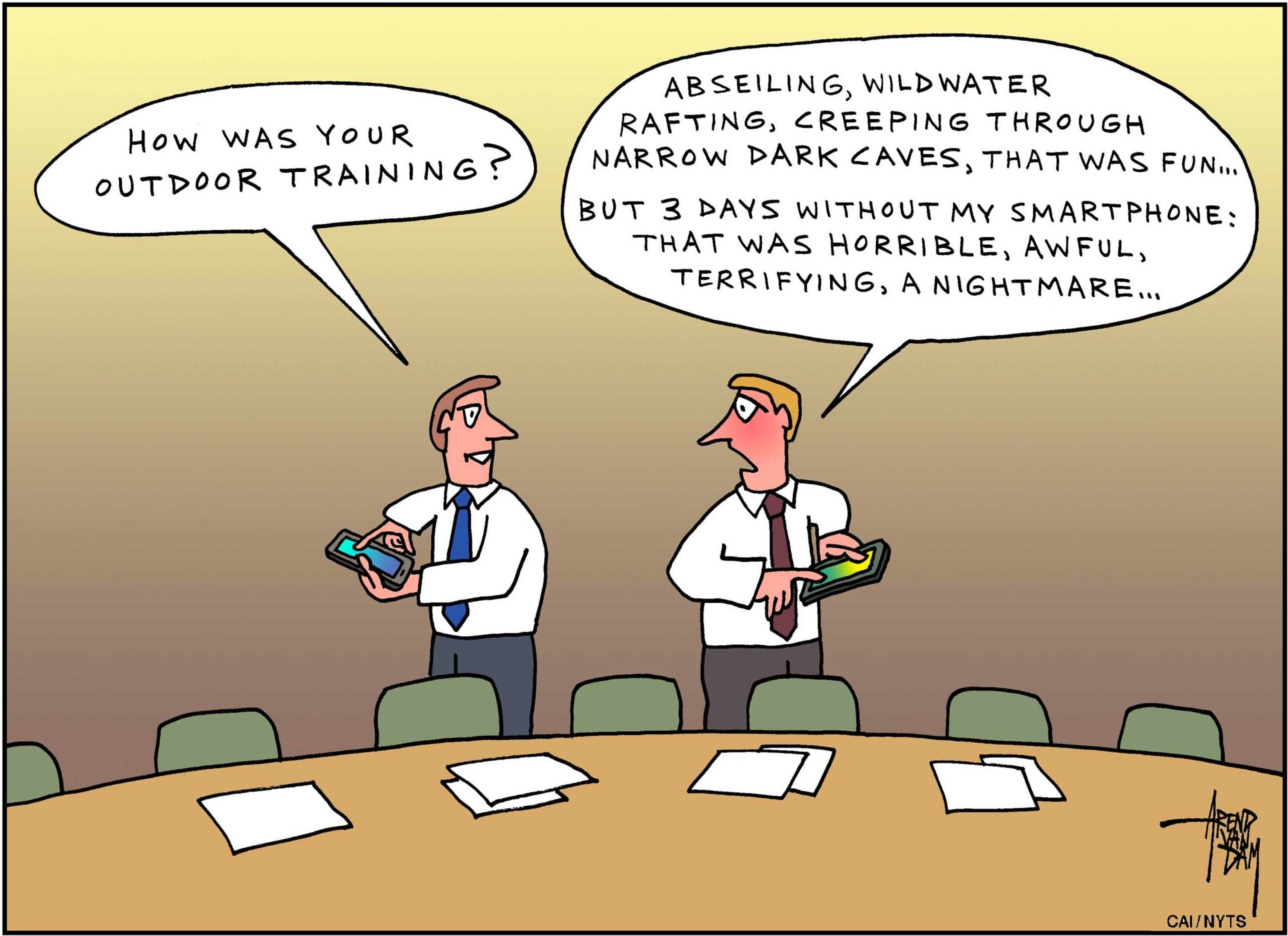

The drop is attributed to a number of factors, including a rise in the average price resulting from the incorporation of advanced features and the drying up of new technologies and functions. But a more fundamental cause is that consumers are getting weary of smartphones.

The past few years saw a sharp increase in the number of users not fussy about the brand, design or model year of their smartphones. This has not only made smartphones just an ordinary commodity item but also has severely impacted smartphone makers, component suppliers and the application industry.