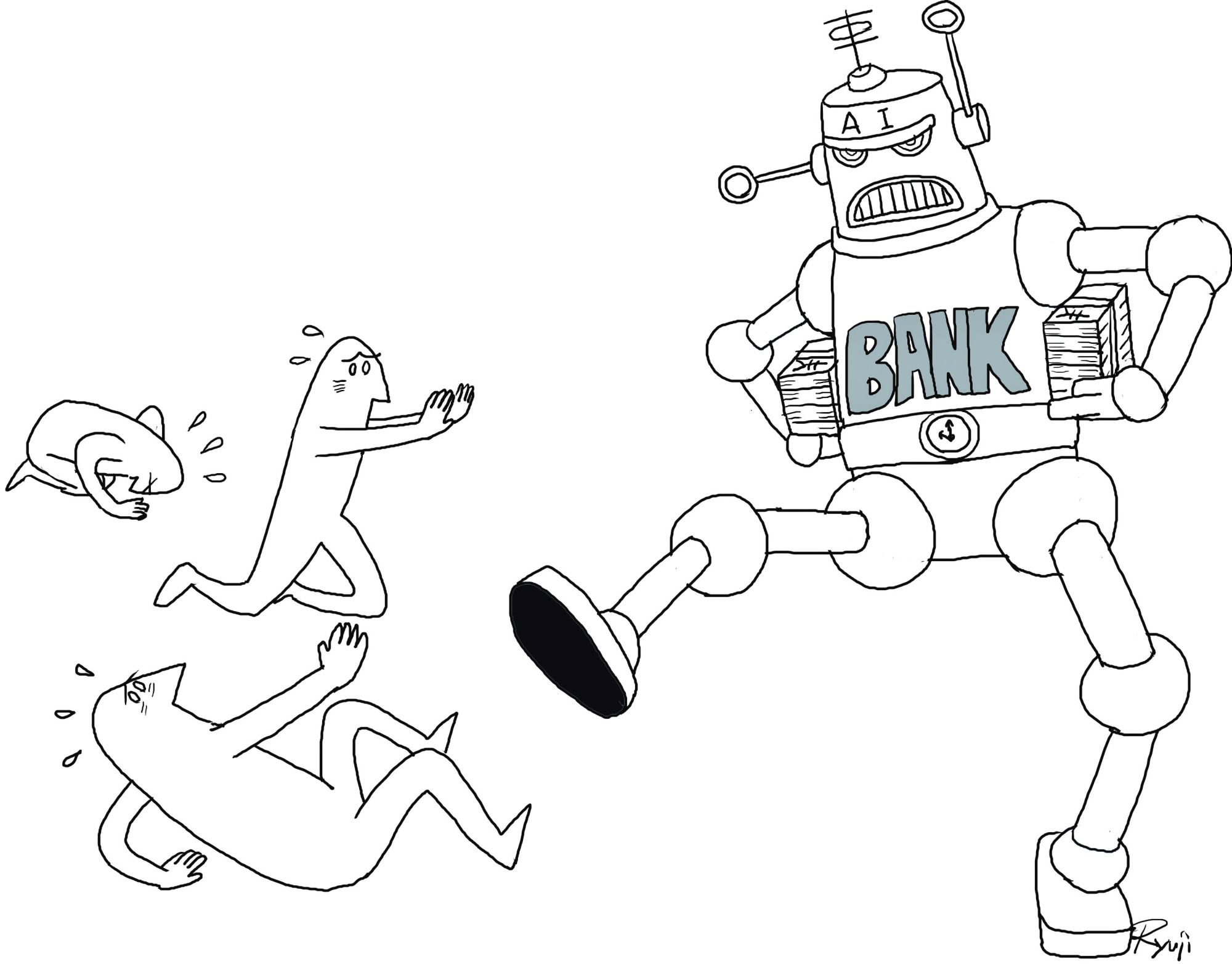

Japan's three major banking groups have unveiled plans for large-scale restructuring programs to streamline their operations. With the expanded use of artificial intelligence and other technology, they are seeking to eliminate work equivalent to a combined total of 33,000 jobs. Although the banks say the redundant manpower will be shifted to other operation, it is feared that a large number of employees could face the ax, especially those who started their career during the bubble boom of the late 1980s to the early 1990s.

An employee of Mizuho Bank in his 40s says the news has turned the atmosphere at the bank chilly. He goes on to say that the impact of automation of the banking operation and the job cuts will not be limited to employees of the banks but extend to their business clients.

Big banks have long been known for turning the cold shoulders to small- and medium-size companies (SMEs) in times of need, as reflected in the frequent complaint that "the bank offers to lend an umbrella when the sun is shining but takes it away when it starts raining." Changes to the loan screening process at major banks will have serious consequences on the fund-raising efforts of their client firms. Smaller banks will likely follow their examples, which could result in many small businesses facing withdrawal or early repayment of loans.