"The market can stay irrational longer than you can stay solvent," said John Maynard Keynes (or maybe it wasn't him, but no matter). At any rate, that was the eternal verity the Saudi Arabians were counting on when they decided to let oil production rip — and the oil price collapse — in late 2014.

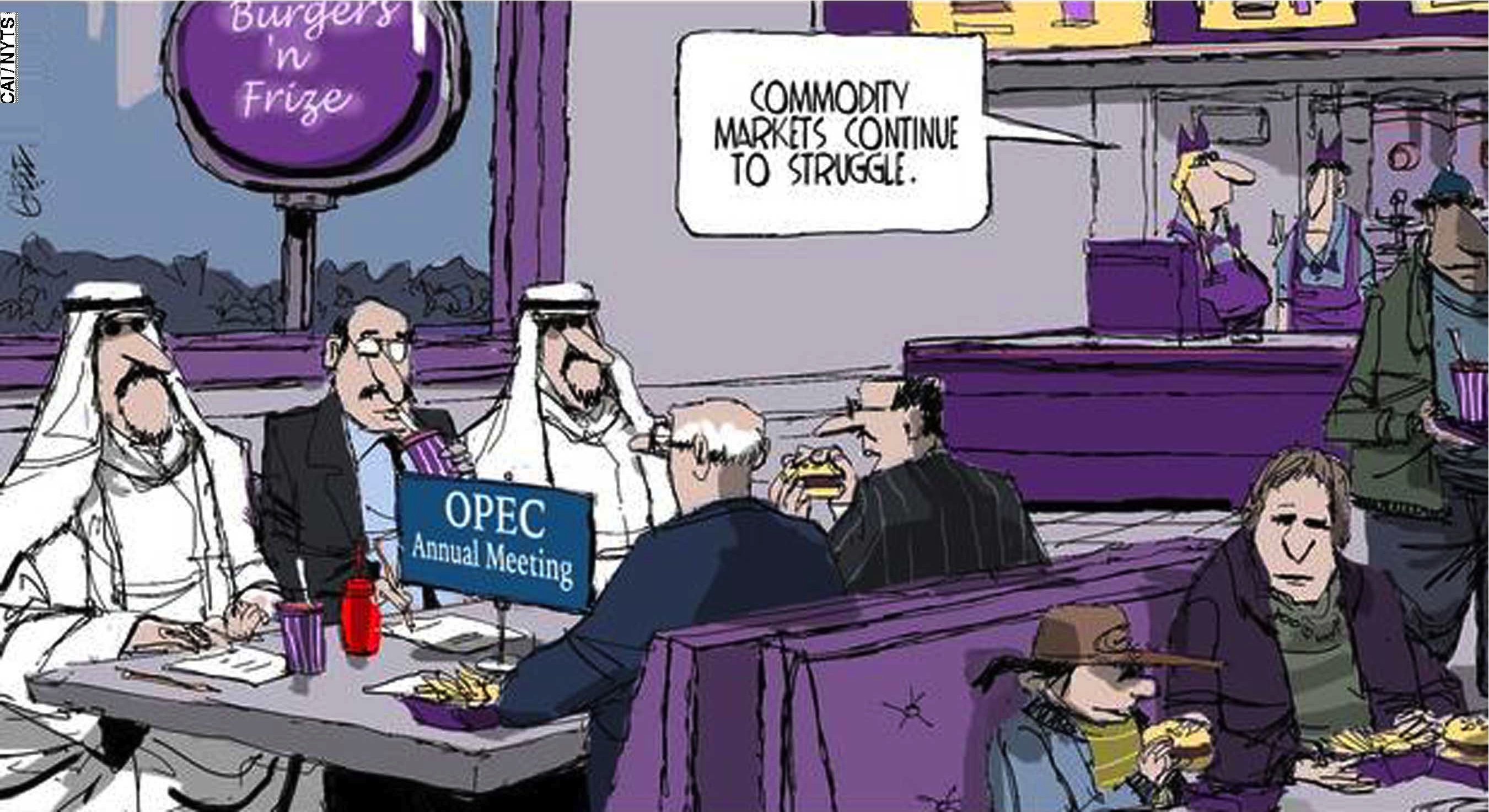

The Saudi objective was to keep the oil price low enough, long enough, to drive American shale oil producers out of business and preserve the OPEC cartel's market share. (The Organization of Petroleum Exporting Countries controls only 30 percent of world oil production, which is already very low for what was meant to be a price-fixing cartel.)

The end of sanctions against Iran and that country's push to raise production and regain its old market share put further downward pressure on the oil price. So did the slowdown in China's economy.