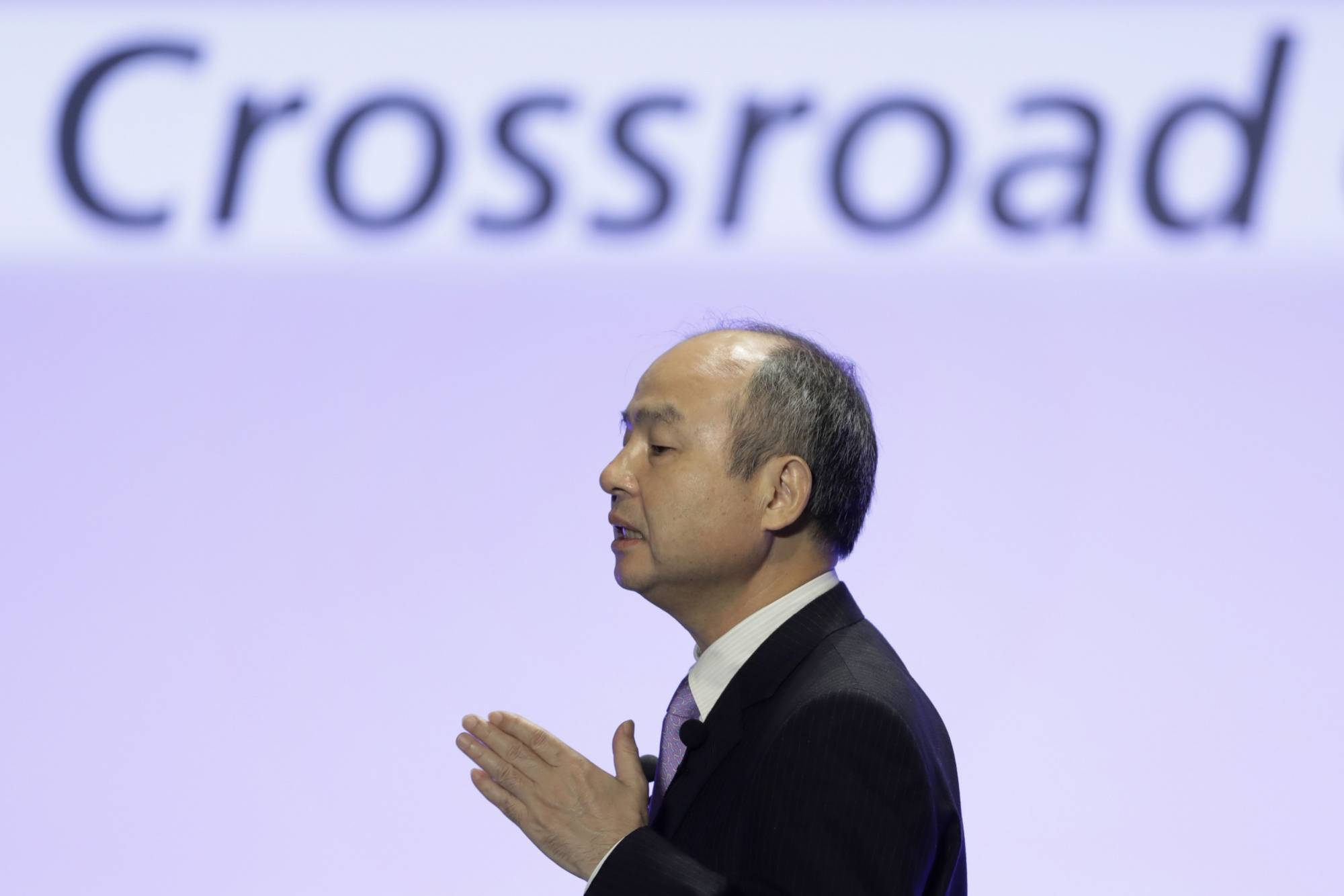

The sudden collapse of Silicon Valley Bank looks set to increase scrutiny of SoftBank Group investments, and possibly drive its share price to Masayoshi Son’s pain point.

The U.S. tech lender’s failure has fueled investor concern over the exposure to start-up firms in the SoftBank Vision Funds. SoftBank shares have plunged 13% in four sessions to below ¥5,000 and are nearing a level that some see as Son’s threshold for announcing a buyback.

The SVB crisis has trained a spotlight on private tech investments, especially following a flight from highly valued stocks as the Federal Reserve started tightening last year. While SoftBank said it expects almost no impact from the U.S. lender’s collapse, few investors think it will emerge unscathed.