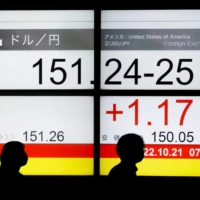

The yen slid to the lower ¥151 zone against the U.S. dollar on Friday in London, hitting a fresh 32-year low on the view that the U.S. Federal Reserve will continue with interest rate hikes to tame rising inflation.

The yen last traded in the zone in July 1990, when Japan was in the final stages of its asset-inflated bubble economy.

The currency had fallen to a 32-year low of ¥150.48 versus the dollar earlier in the day in Tokyo, and its downswing accelerated in London.

The dollar drew buying as the 10-year U.S. Treasury yield maintained its upward tone after touching a new 14-year high on Thursday, following hawkish remarks from Federal Reserve Bank of Philadelphia President Patrick Harker.

Harker said he expects the U.S. central bank's benchmark policy rate to "be well above 4%" by the end of this year from the current target of 3 to 3.25%.

The yen's continuing depreciation comes amid speculation that Japanese monetary authorities may intervene to prop up the currency. The authorities last conducted a yen-buying, dollar-selling operation on Sept. 22, when the yen was trading at the ¥145.90 level.

The yen's decline reflects a widening interest rate gap between Japan and the United States as the Bank of Japan remains committed to its dovish stance while the Fed is expected to raise rates further.