Mizuho Financial Group Inc. said Friday that most services at its local branches had been restored after an earlier digital glitch — its fifth in less than six months — drew criticism from the government.

"It gravely hurts public trust in financial institutions. It’s very regrettable,” Chief Cabinet Secretary Katsunobu Kato, the top government spokesman, said at a briefing Friday. Finance Minister Taro Aso, who oversees the financial regulator, told a separate briefing that they are monitoring how Mizuho is handling the incident.

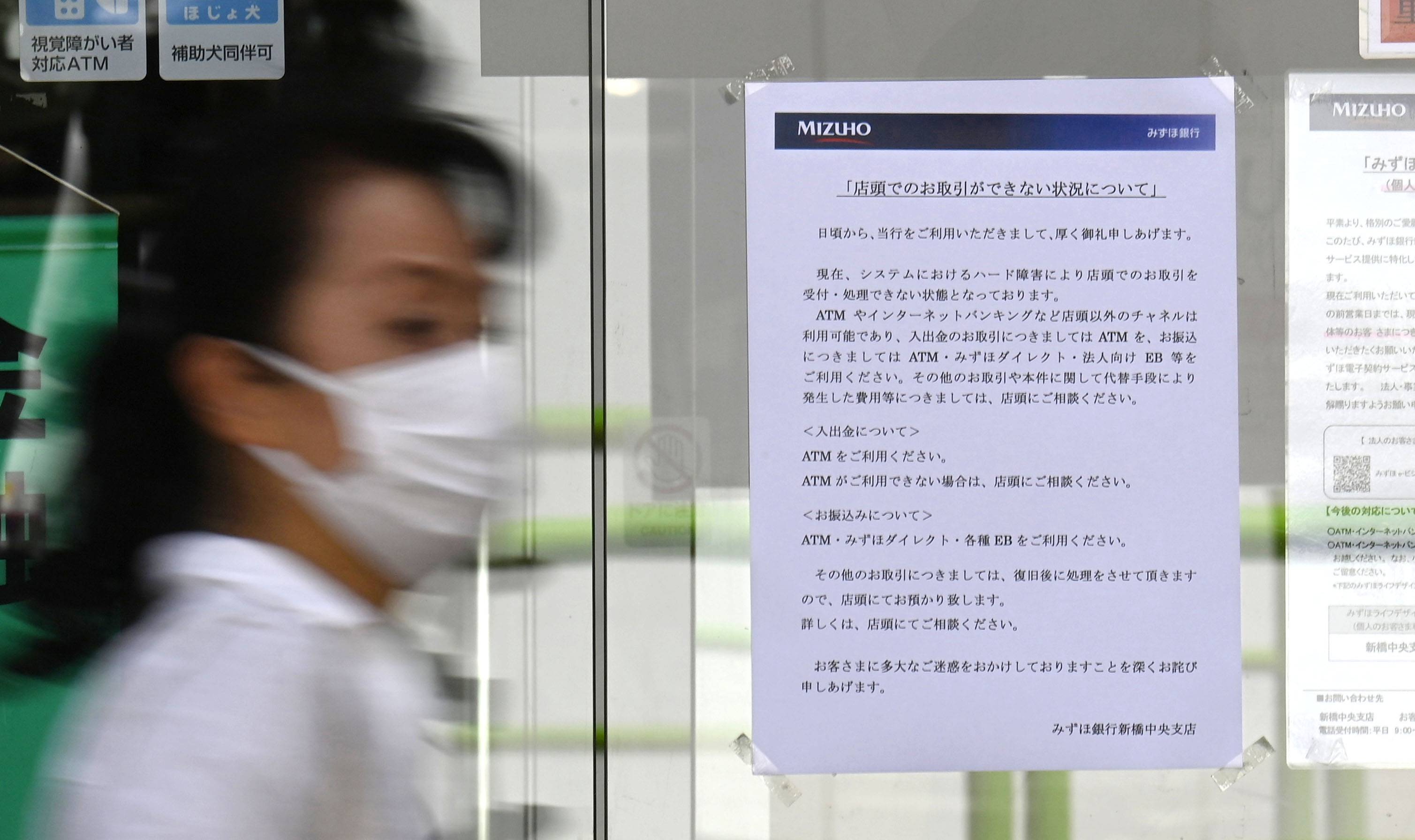

All 460 Mizuho Bank branches nationwide were not able to process transactions for about an hour on Friday morning due to an IT hardware failure the previous night. A spokesman later said most of the services have been restored, while online transactions and ATMs were not affected.

The problem comes as regulators finish up their on-site inspections on the bank’s system failures earlier this year, which include ATMs swallowing more than 5,000 cash cards and passbooks in late February. The Financial Services Agency was set to determine whether it will take punitive action against Mizuho after examining its findings from the probe.

Troubles earlier in the year prompted the lender to backtrack on a series of key appointments. Koji Fujiwara has remained CEO of Mizuho Bank after April 1 to deal with the problems, instead of being succeeded by Managing Executive Officer Masahiko Kato and becoming chairman.

In June, the bank announced a set of measures to overhaul its corporate governance and other issues to prevent the recurrence of system troubles. Top management also took pay cuts.

Mizuho has been penalized for computer failures in the past, including an outage that delayed money transfers in the aftermath of the Great East Japan Earthquake and tsunami 10 years ago.