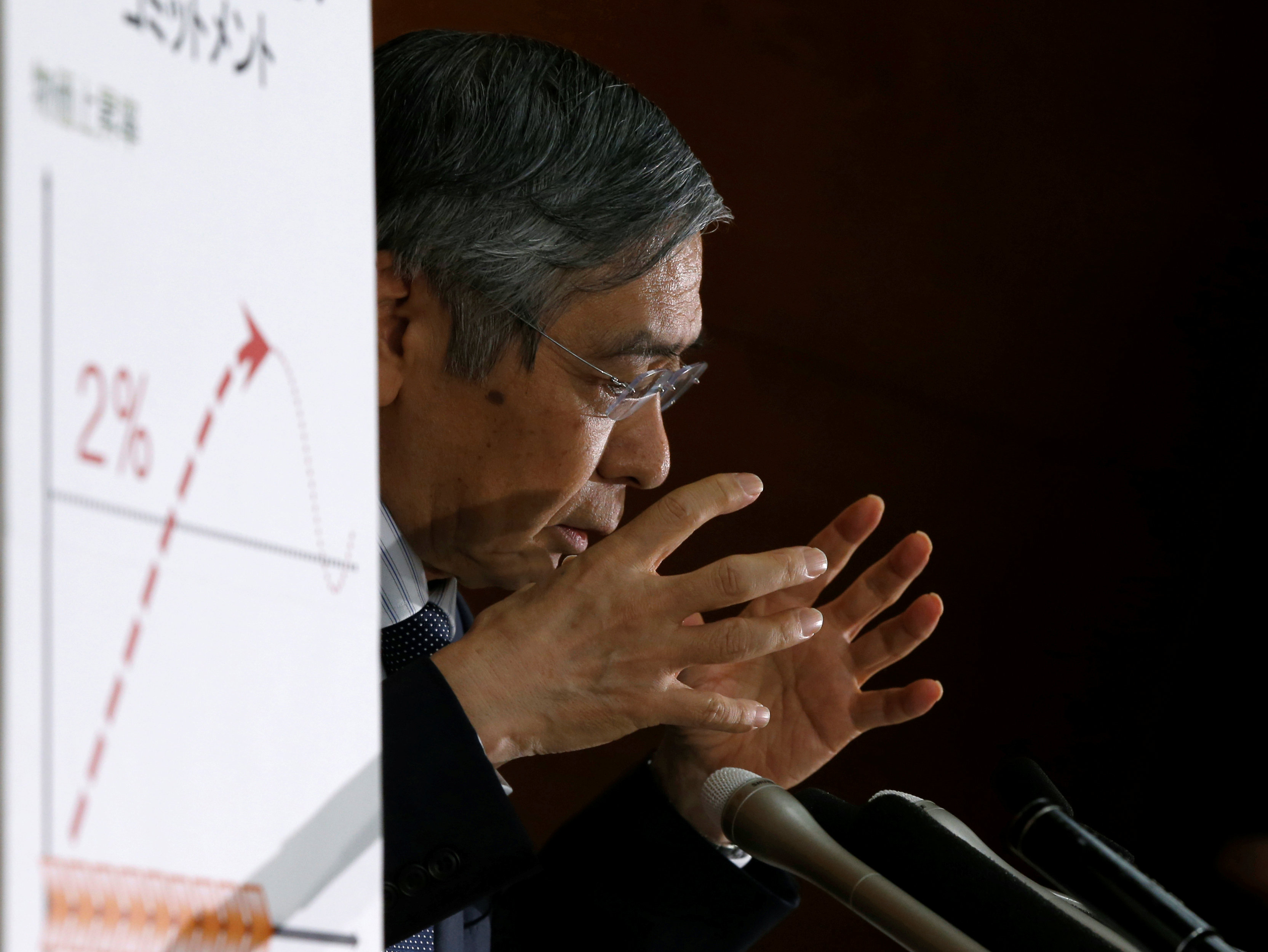

Bank of Japan Gov. Haruhiko Kuroda stormed onto the global stage back in 2013 with the subtlety of a Metallica concert, electrifying markets with a shock-and-awe monetary expansion powered by increased purchases of Japanese government bonds.

On Wednesday, Kuroda seemed a little bit more like a jazz musician, riffing variations on established themes. It's not the sort of stuff that quickens the hearts of investors.

The BOJ refrained from another interest rate cut and instead pledged to bolster the long end of the bond market's yield curve. It's a move that will help Japanese banks, pension funds and insurers cope in a less-than-zero rate environment, but disappointing to economists who had hoped for more dramatic action. At the same time, the central bank pledged to keep its monetary base — bank cash reserves and currencies in circulation — growing until after inflation exceeds the 2 percent target that was set back in 2013.