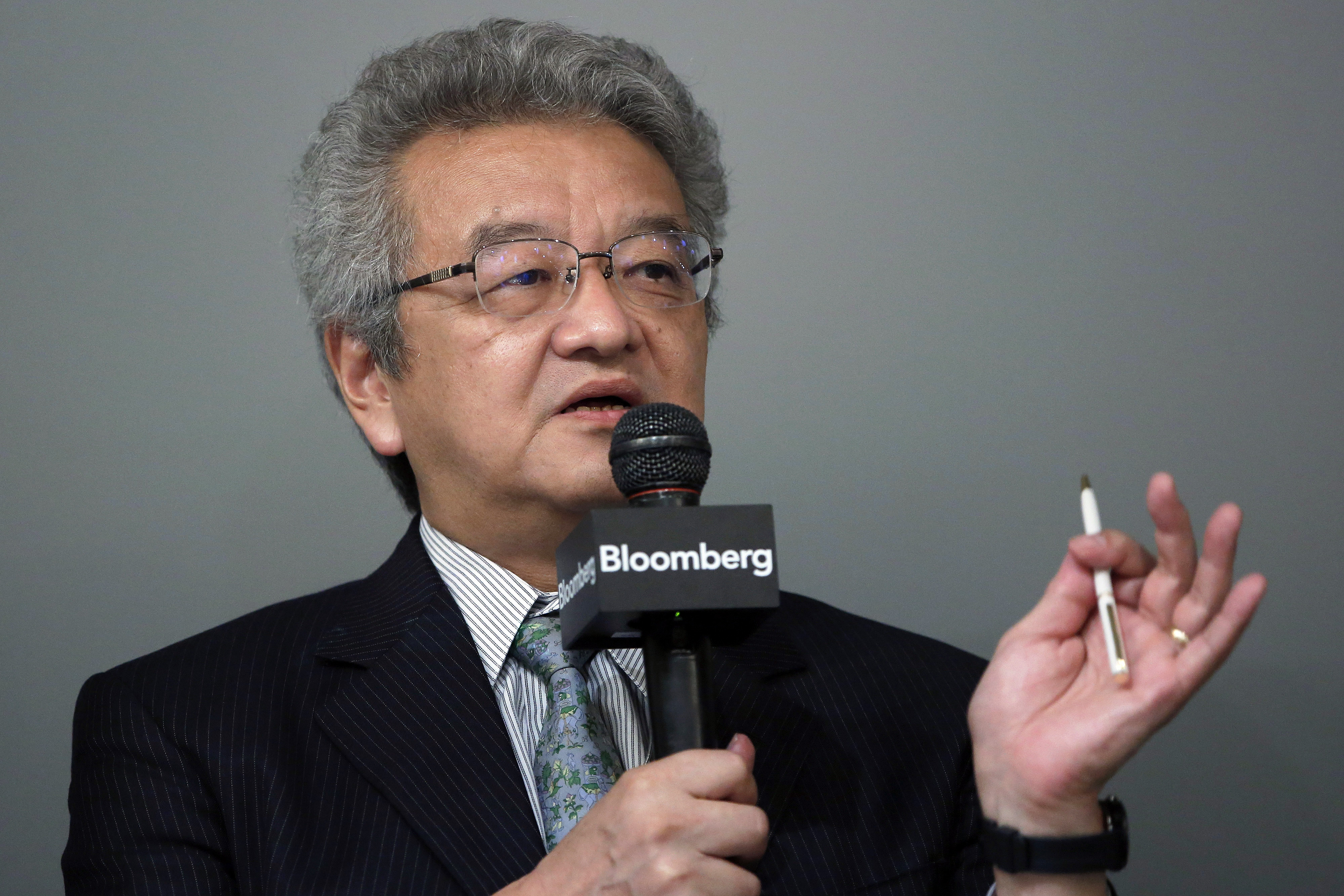

Japan's ¥127 trillion retirement fund may delay announcing its portfolio review until December, according to Takatoshi Ito, who was a top adviser to the government on overhauling public pensions.

A debate is underway on whether the Government Pension Investment Fund should buy and sell assets before publishing new allocation targets, Ito said Tuesday.

Should the GPIF decide to do so, a postponement until December would be necessary, he said.