On Dec. 11, 2014, the student-initiated 75 day mass demonstrations of the "umbrella movement" ended with orderly execution of a forced expulsion by the Hong Kong police. They avoided another bloodbath similar to that of the Tiananmen Square protests of 1989. The incident, however, shows that political liberalization is incompatible with communist dictatorship.

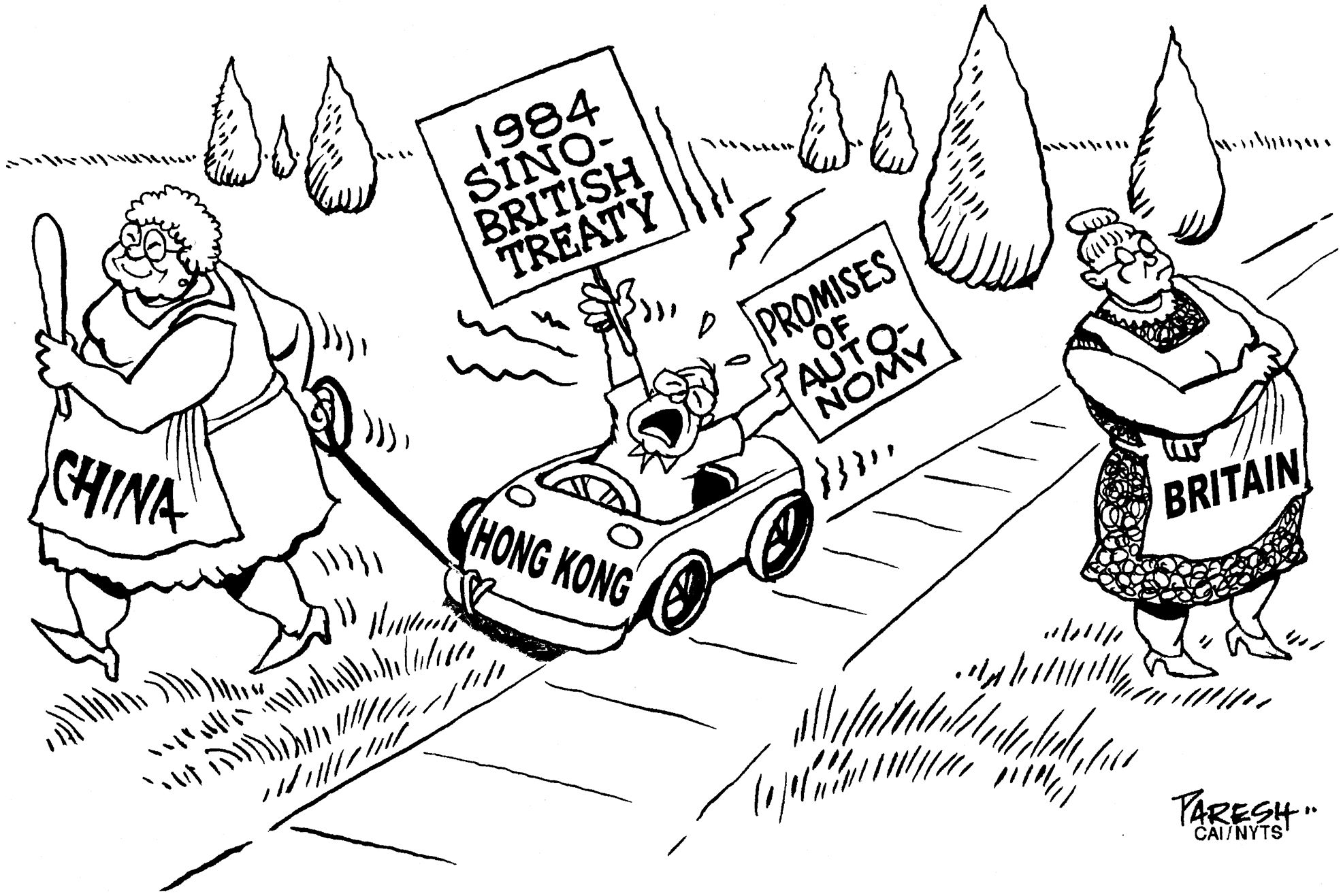

No wonder that, seeing its survival eventually jeopardized, Beijing's communist regime did not heed the protesters' demand for free election of the chief executive of the Special Administrative Region, scheduled to be held in 2017 according to the pre-reversion Britain-China agreement.

The Beijing regime is resolute on imposing new rules designed to keep liberal democratic candidates out of office. The world was watchful of Beijing's move because it seemed to be caught between a rock and a hard place.