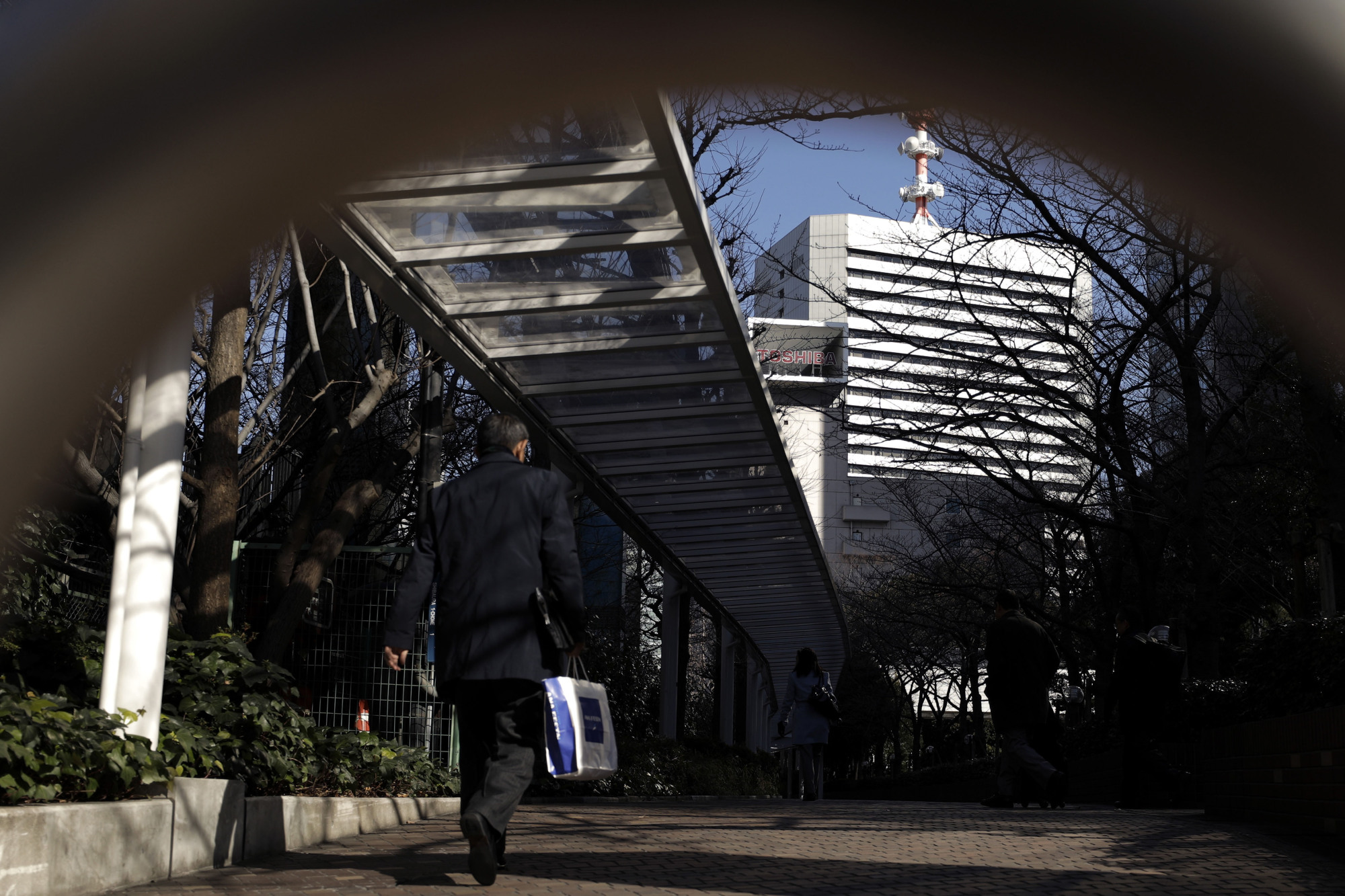

Toshiba Corp., seeking to make up for a huge write-down in its nuclear-equipment unit, finally took the drastic step of putting its crown jewel — its chip business — up for sale. Finding a buyer might prove to be even more difficult.

The Tokyo-based conglomerate had been entertaining offers for a minor stake in the flash-memory operations, until it booked a $6.3 billion write-down in its nuclear unit this week. President Satoshi Tsunakawa said he's now open to selling a majority share or even the entire division to repair the company's balance sheet. The search for a buyer is likely to last beyond Toshiba's earlier March 31 deadline for the deal, a person familiar with the matter said.

For competitors SK Hynix Inc., Western Digital Corp. and Micron Technology Inc., buying Toshiba's business would represent a rare opportunity to close the gap with market leader Samsung Electronics Co. Demand for flash, or NAND, memory is still robust because it's the main storage in the more than 1 billion smartphones sold every year, and it's increasingly being used in data centers to house the flood of data created as computing shifts to the cloud.