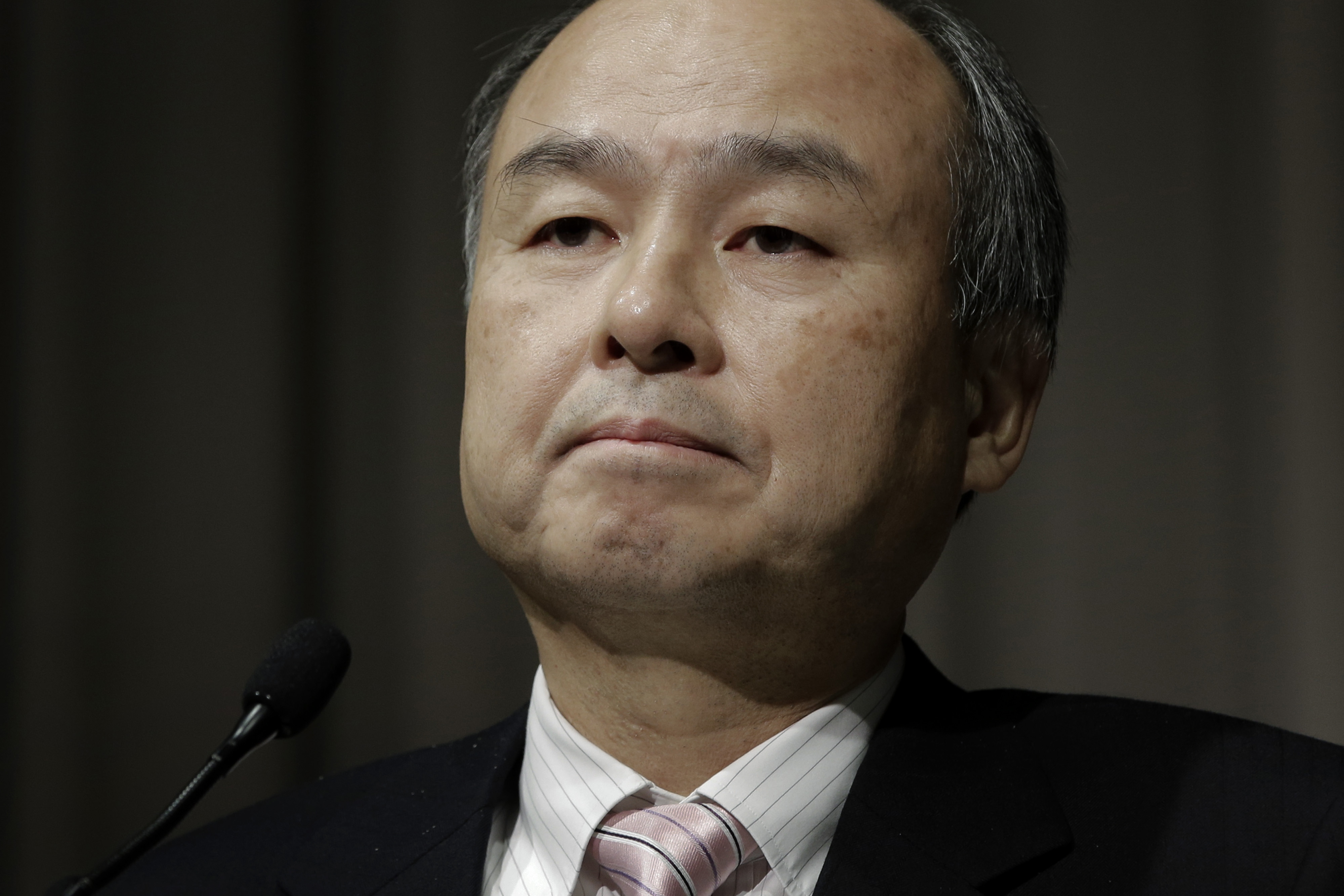

Masayoshi Son's promises of a turnaround for his U.S. operations and a record share buyback have not been enough to erase SoftBank Group Corp.'s $22 billion valuation gap. The billionaire founder has at least one more card to play — listing the company's domestic telecommunications business.

SoftBank has a market value of about $65 billion, while its public shareholdings are worth ¥9.4 trillion, according to data compiled by Bloomberg. The stake in Alibaba Group Holding Ltd. alone is almost equal to the entire equity of the Japanese company whose portfolio also includes the country's third-largest wireless service.

Son transformed SoftBank from a distributor of computer software into a technology giant through acquisitions of telecom assets and early investments in startups like Alibaba. But he stumbled with more recent moves, including the purchase of money-losing Sprint Corp., spooking investors who have discounted the value of his shares. In addition to stakes in Alibaba, Sprint and Yahoo Japan Corp., SoftBank owns a Japanese phone business that could be worth $24 billion, based on the value of rival KDDI Corp.