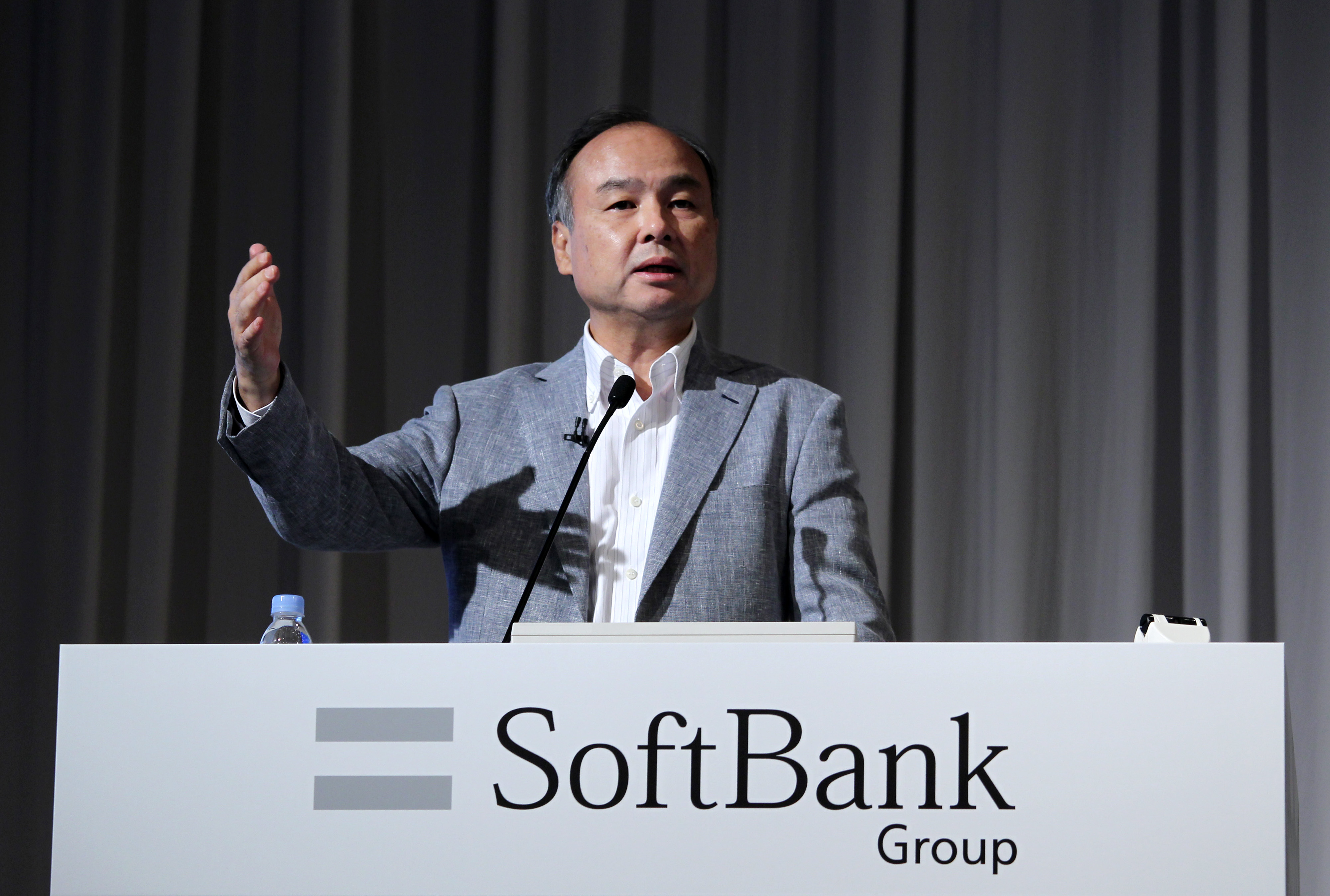

Billionaire Masayoshi Son considered conducting a management buyout of SoftBank Group Corp. earlier this year and entered talks with an overseas partner, according to people with direct knowledge of the plan.

Son had talks with at least one lender before scrapping the plan at least three months ago when he could not agree with the overseas partner on financing conditions, the people said, asking not to be identified because they are not authorized to discuss the matter. While it was the top possible deal earlier this year, Son is no longer considering using that partner, the people said without elaborating.

Concerns about debt and struggling U.S. unit Sprint Corp. have driven SoftBank's market value down to about $64 billion, or less than the stakes it holds in companies including Alibaba Group Holding Ltd. and Yahoo Japan Corp. A deal excluding Son's 19.3 percent stake would be the biggest management buyout ever, according to data compiled by Bloomberg.