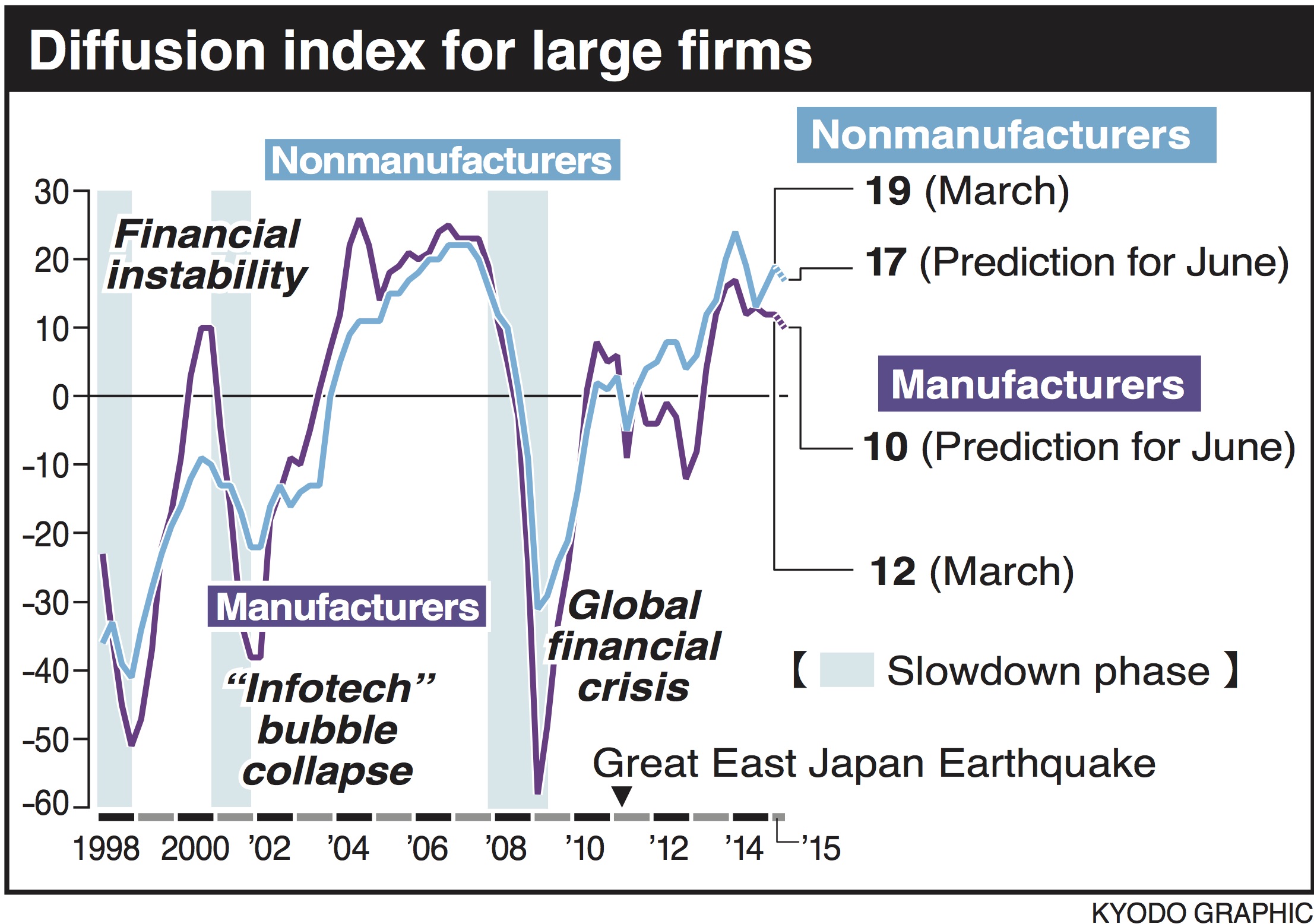

Business sentiment among large manufacturers was unchanged in March from three months earlier and is expected to worsen, the Bank of Japan's "tankan" survey showed Wednesday. The assessment reflected corporate caution despite earnings recovery amid a weaker yen and falling oil prices.

The central bank's diffusion index for companies such as major carmakers and large electronics firms held steady at 12, weaker than the average forecast of 14 in a Kyodo News survey of economists. Looking ahead, the index is expected to worsen to 10 in June.

The index for nonmanufacturers including retailers and construction firms improved slightly to 19 from 17, apparently due to benefits from greater numbers of foreign tourists visiting Japan. That compares with the average projection of 16.