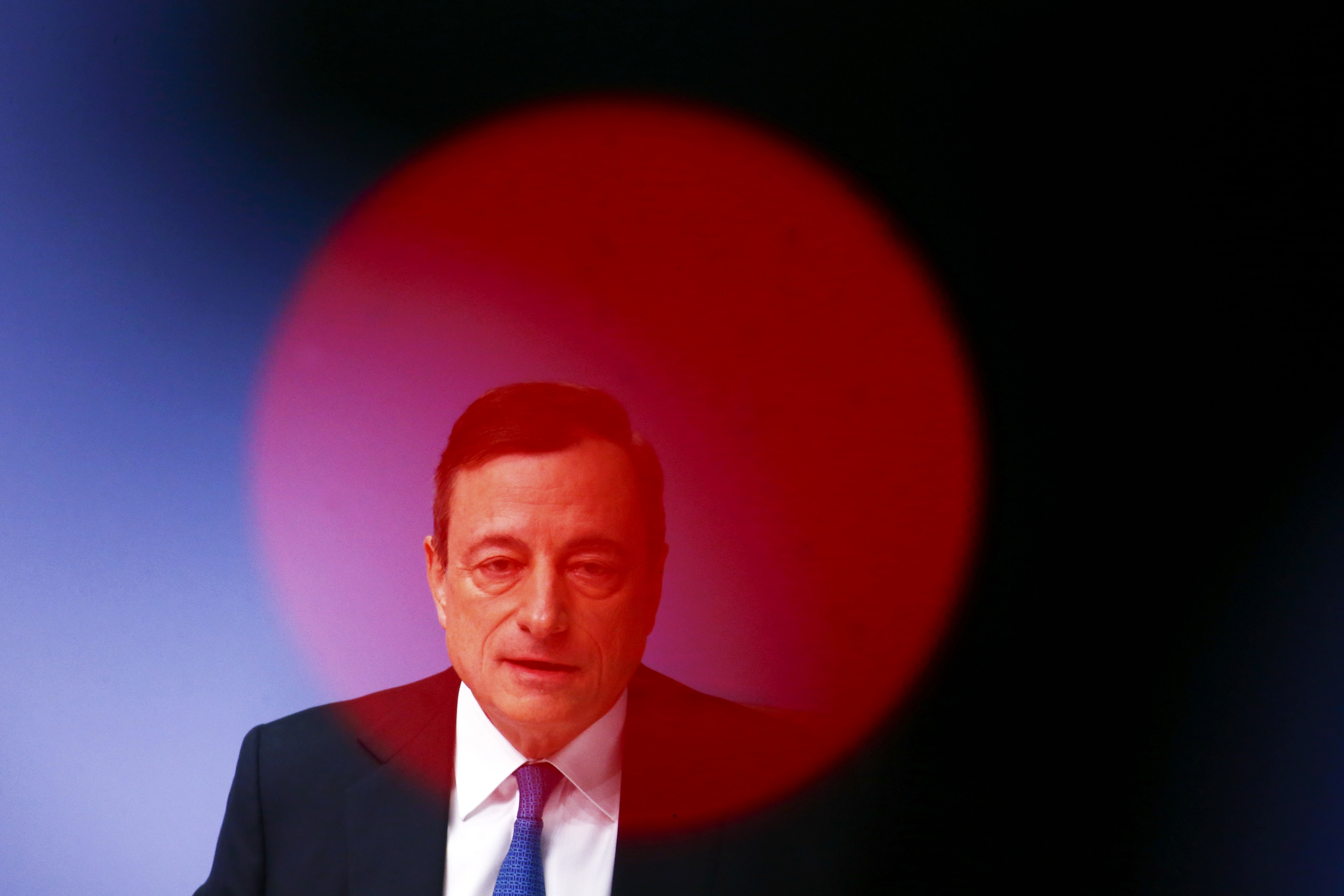

Mario Draghi led the European Central Bank into a new era with a historic pledge to buy government bonds as part of an asset-purchase program worth about €1.1 trillion ($1.3 trillion).

The ECB president side-stepped German-led opposition to quantitative easing in a once-and-for-all push to revive inflation and the euro-area economy. The central bank will buy €60 billion per month of securities until September 2016. The ECB also reduced the cost of its long-term loans to banks.

A near-stagnant economy and the risk of deflation forced Draghi's hand six years after the Federal Reserve took a similar step to inject cash into the U.S. The 67-year-old Italian's gamble is that the benefits of quantitative easing outweigh the threat of a backlash in Germany.