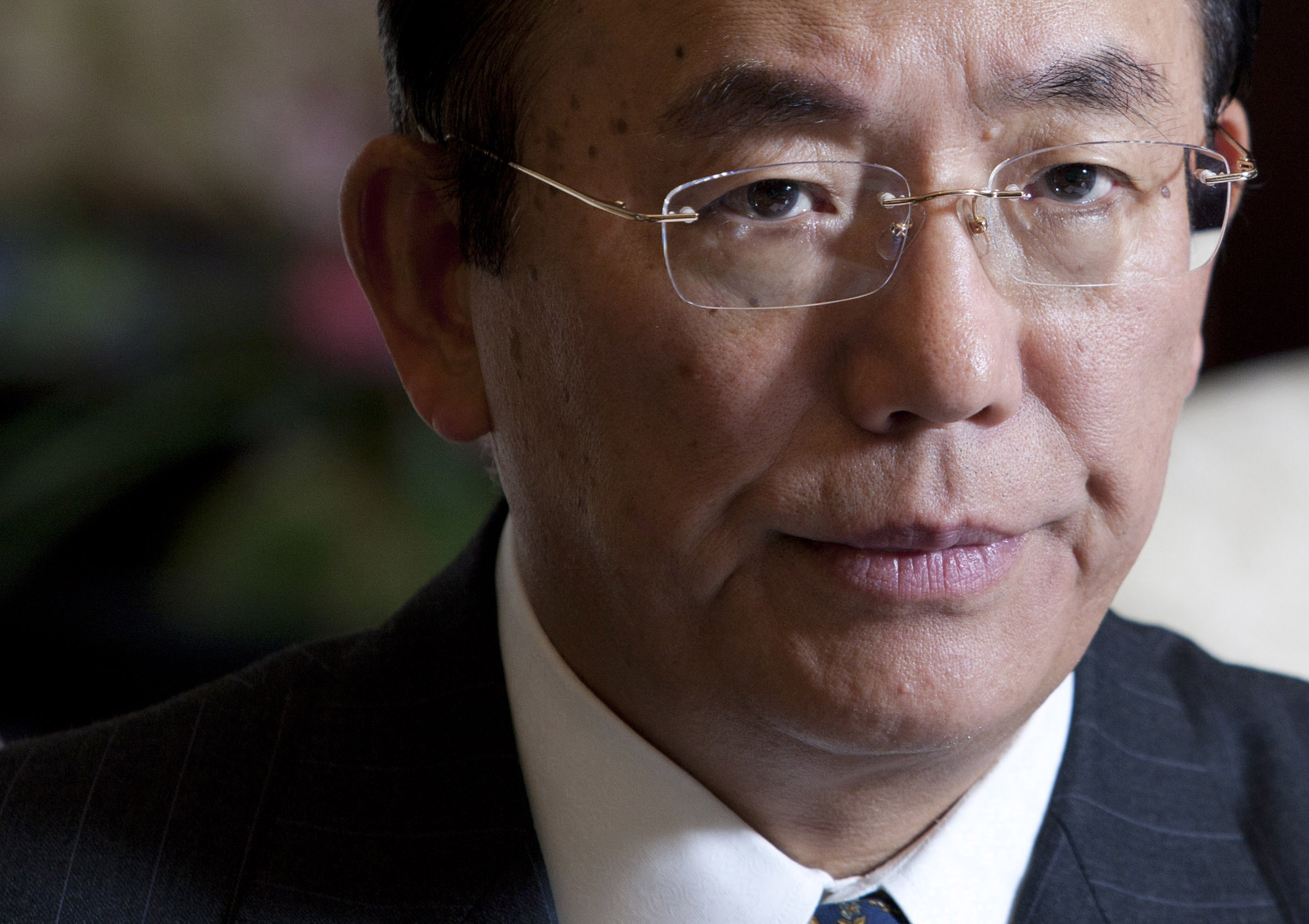

The Bank of Japan may need more time to achieve its 2 percent inflation target and the country can't ignore harm caused by an abrupt weakening of the yen, said Toshiro Muto, a two-time contender to lead the central bank.

"The hurdle is pretty high to meet the price goal within their targeted time period of about two years," said Muto, 71, a former deputy governor who is now chairman of the Daiwa Institute of Research. "It's a realistic approach to push back the timing."

Even as the yen's decline to a six-year low against the dollar swells Japan's import bill, price gains have slowed to 1.1 percent. Companies surveyed by the BOJ are forecasting inflation lower than its goal for the next five years.