A consortium of Japanese companies used code names and secret meetings to rig bids for dozens of types of auto parts imported to the United States in a decade-long conspiracy that may have cost U.S. consumers hundreds of millions of dollars, U.S. officials announced.

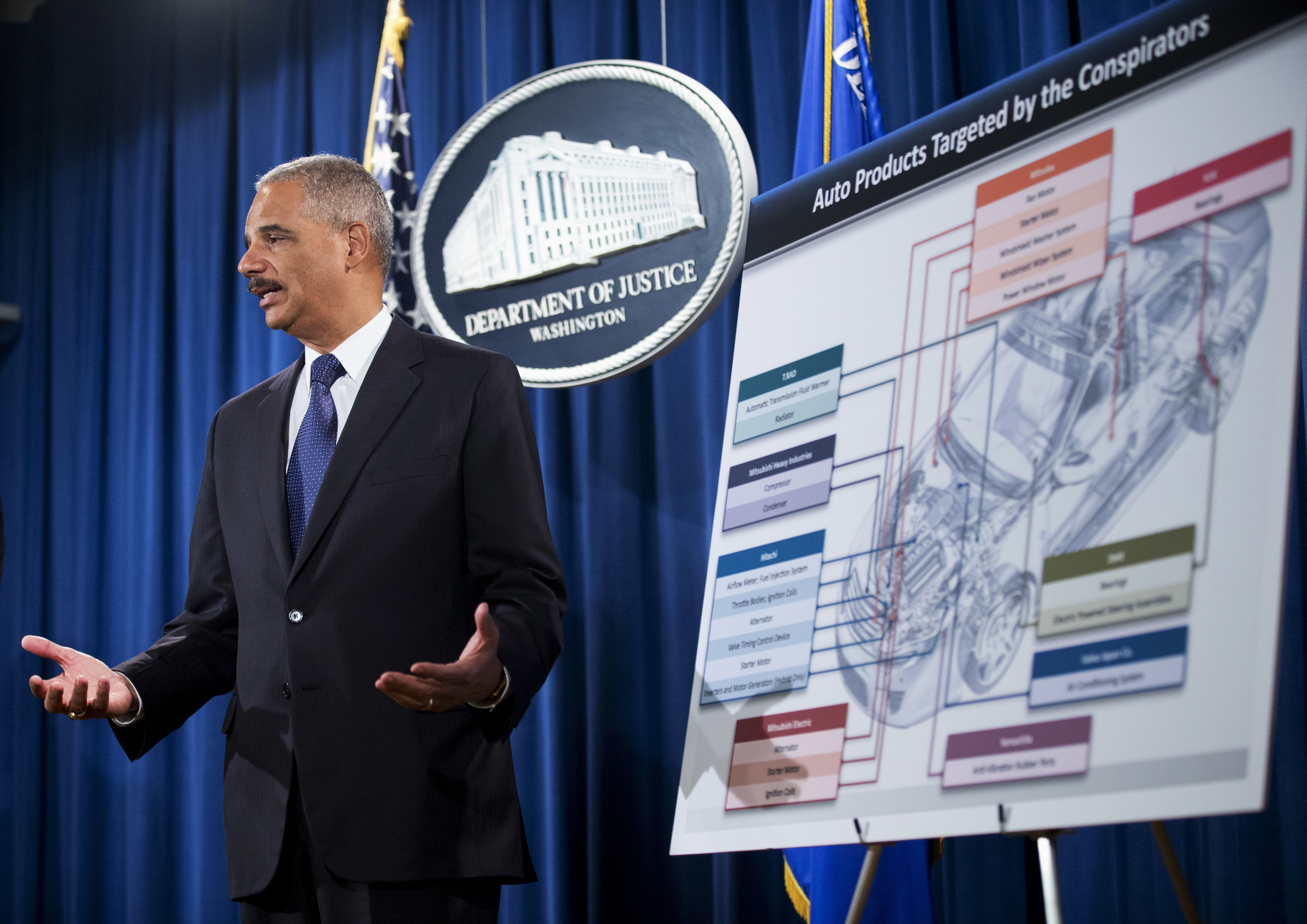

Unveiling Thursday what the Justice Department said is its largest-ever criminal antitrust investigation, Attorney General Eric Holder said nine companies had agreed to plead guilty in the case and pay roughly $740 million in fines.

They included Mitsubishi Heavy Industries, Hitachi Automotive Systems and Mitsubishi Electric. Two executives also pleaded guilty, and one will face a one-year prison term.