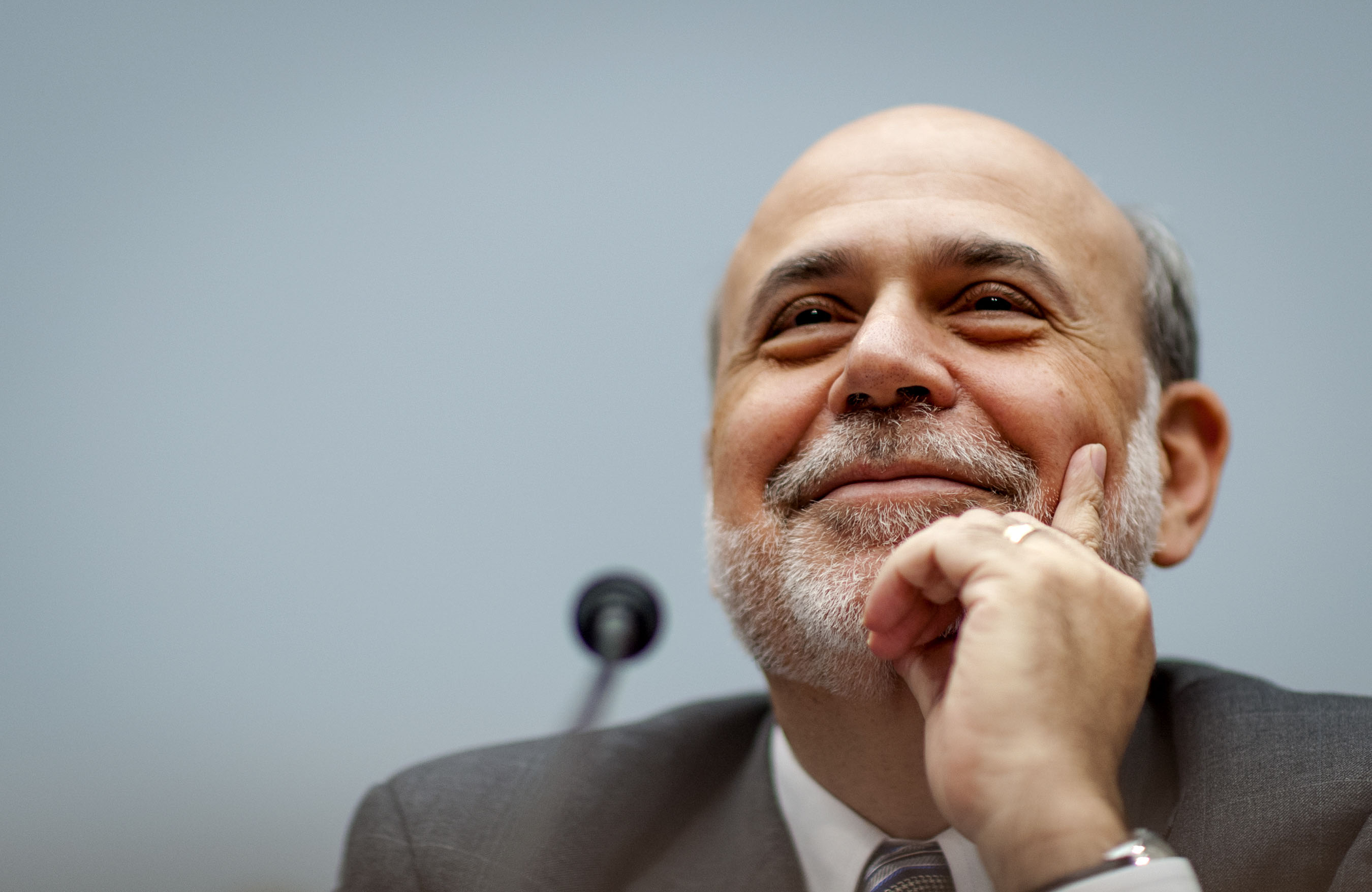

Each August for the past several years, a conference room on the third floor of the Jackson Lake Lodge has been stocked with financial data terminals, secure phone lines and all the other accessories that Ben Bernanke and his top lieutenants at the Federal Reserve might need to fight a global financial crisis.

Many of the world's leading central bankers are back at their annual economic symposium in Jackson Hole this weekend. But the conference room is empty.

The crisis — which started in subprime U.S. mortgages six years ago, engulfed banks on both sides of the Atlantic, brought the worst recession in generations and drove several European countries to the brink of bankruptcy — is for practical purposes over.