The man who has become the face of Detroit's historic bankruptcy planned to spend his weekend at home in Chevy Chase, Maryland, corralling the ferns that are overgrowing their planters and threatening his garden. Or maybe taking his two young children to the pool.

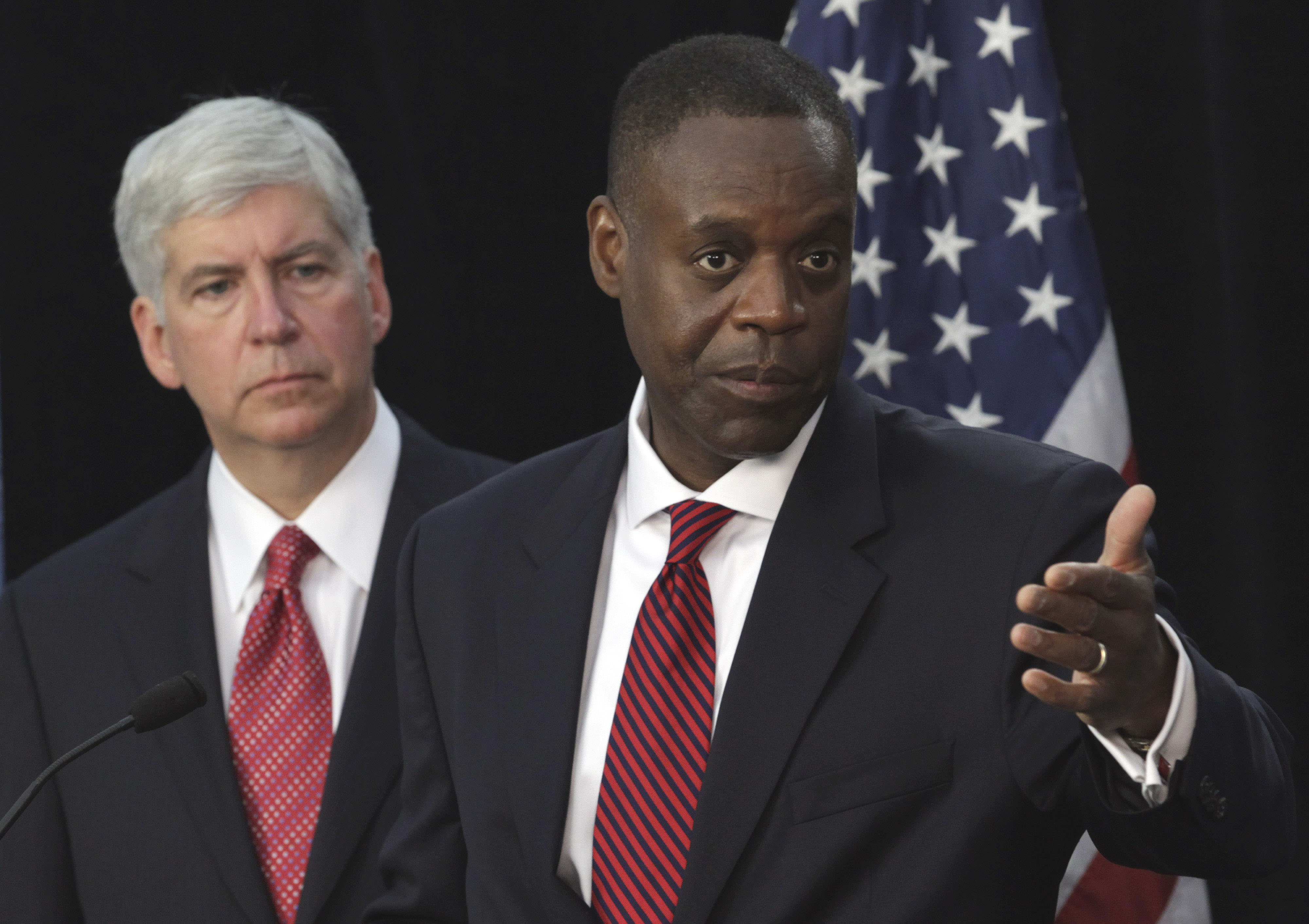

Long anonymous to most of Washington, Kevyn Orr is among a tiny handful of prominent African-American corporate turnaround lawyers in the country. Until recently, he was perhaps best known for helping guide Chrysler through its wrenching but ultimately successful 2009 bankruptcy.

Now Orr has rocketed to national prominence for his lead role in trying to free Detroit from at least $18 billion in debt. He is also charged with restoring basic services that have eroded to dangerous levels during the Motor City's six-decade descent from industrial capital to urban basket case.